Money Will Be Made On the Short Side Today – Fade the Early Bounce

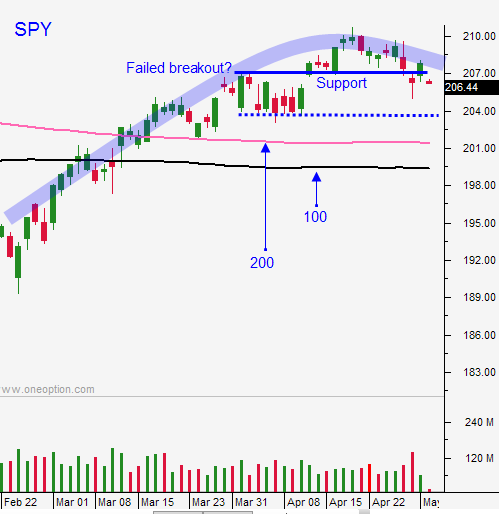

Posted 9:00 AT ET - The market has broken support at SPY $207 and it will challenge the lows from last week this morning. Mega cap tech stocks disappointed and we are seeing profit-taking. Stocks are fully priced and there is not a catalyst to push us higher. I believe major support at SPY $200 will be tested in the next month.

Central bank money printing (BOJ, PBOC and ECB) sparked the rally the last two months and that stimulus is gone. The FOMC stated that global risks have receded and the rhetoric is a little more hawkish.

Commodity stocks surged higher as the dollar retreated. Short covering fueled the move and the basic materials sector looks like an excellent short. Global economic conditions don't support current price levels and we started to see this sector rollover yesterday.

ADP reported that 156,000 new jobs were created in the private sector during April. This number was about 40,000 shy consensus estimates and it could be a sign that US employment is hitting a soft patch. ADP has its finger on the pulse of the economy and I give this report much more credence than the Unemployment Report.

Donald Trump will be the Republican nominee and good or bad, it will take some uncertainty out of the market. A contested GOP convention could have gotten ugly.

Greece needs to secure a loan and there is a 50% chance that England could leave the EU. Brazil's economy is on the ropes and they are dealing with massive corruption at the highest level. They are not prepared for the Olympics and their dire condition will be on display. These dark clouds are on the horizon and they will prompt profit-taking in the next few weeks.

I have been scaling into bearish positions this week and I am holding them overnight.

During the trading day I am fairly balanced after the first hour. I have been able to find excellent longs and shorts.

When the S&P 500 makes an overnight move greater than 10 points I like trading against the move. For instance, yesterday the S&P was down 23 points and I waited patiently for signs of support. I lined up stocks with relative strength that fit the pattern I trade and I watched them coil like a spring. When the market stopped falling, I bought them. These stocks released and I made excellent money fading that opening move.

The selling pressure has been more pronounced in the last few days and the opening decline today could be sustained. I am likely to short into an early bounce this morning. I need to see the price action unfold and then I can get an accurate read on direction. I post play-by-play market comments in my chat room and I keep my members on the right side of the action.

My gut tells me that an early bounce this morning will fail and that most of my money will be made on the downside today.

I think it's wise to have some overnight bearish exposure for the next few weeks. Don't go overboard. The market is directionless and we will see a couple of down days followed by a couple of updates. The down days will be greater in magnitude and there will be a negative bias. This type of price action makes it difficult to carry large overnight short positions.

Late day selling is a bearish sign and I believe we will see it today.

The volume should be excellent today and I'm looking forward opportunities on both sides of the market. Given my comments, you know that I like shorting basic material stocks.

Watch for an early bounce that stalls quickly. The low of the first hour will fail and the market will drift lower. This type of price action would prompt me to trade aggressively from the short side. If the first hour range holds for a couple of hours, I will use a more balanced approach of longs and shorts.

.

.

Daily Bulletin Continues...