Buy Puts If the Market Makes A New Low After 2 Hours Of Trading

Posted 9:40 AM ET - Monday the SPY started the week on a positive note and stocks floated higher all day. Many global markets were closed and the volume was light. This morning, those gains are being stripped away.

Stocks are fully priced and the market momentum has stalled. Mega cap tech stocks disappointed investors and bears will be a little more aggressive. We are also likely to see some profit-taking. Global credit concerns are always looming and there are some nagging issues (Brexit and GOP convention) that stand before us.

Basic material stocks and industrials have led the charge. Global growth is not strong enough to support current price levels and I believe these stocks will retreat. Unfortunately, there aren't any other sectors that look strong enough to assume the leadership role.

The economic releases this week should be decent, but not strong enough to spark rate hike fears.

Yesterday I mentioned that I was passively bearish. That means I believe the market will decline, but in an orderly manner. This pattern will be three steps down and two steps up.

I will focus on day trading. This is my bread-and-butter strategy and it has worked well all year. I can't count on overnight moves because the market lacks direction. My swing trading will be minimal until I see late day selling (they I will carry some bearish overnight positions).

When the S&P 500 moves more than 10 points overnight, I like fading that early move. This morning I will look for opportunities to get long. Stocks with relative strength will be easy to spot and I will buy them once the market finds support. Once we are through the first hour of trading, I will use that range as my guide.

I am selling a few out of the money bearish call spreads. This is not a large portion of my capital, but there are some nice opportunities to generate income.

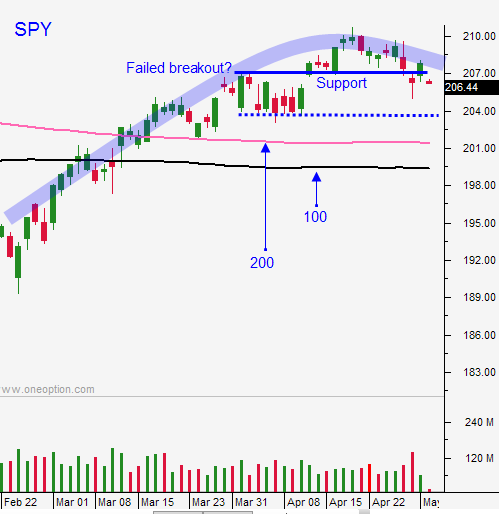

The market should be able to find support near the lows from last week. SPY $207 will be breached and the next support level is $204.

If the market makes a new low after a few hours of trading, we will drift downward the rest of the day. This type of price action would get me bearish and I would buy VXX with the intent of holding overnight.

I am also long BZQ for a longer-term bearish position. This allows me to take advantage of high basic materials prices, shaky emerging market credit and optimism ahead of the Olympics (which I believe will be a disaster).

Look for an early bounce and then use the first hour range as your guide.

.

.

Daily Bulletin Continues...