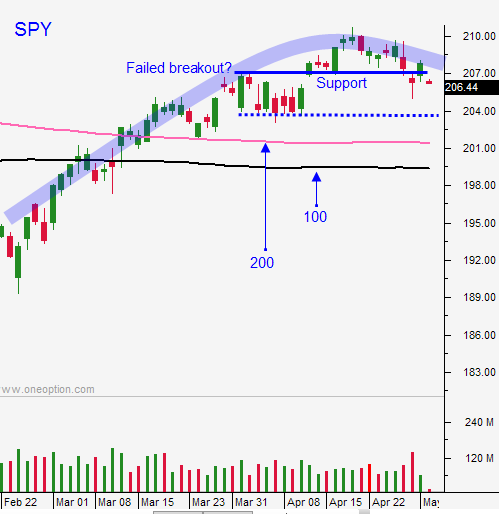

Market Will Test Major Support In the Next Month – Choppy Drift Lower

Posted 9:45 AM ET - The market has gradually been drifting lower the last two weeks and support at SPY $204 was challenged last Friday after a weak jobs report. One data point does not make a trend and buyers took comfort knowing that the Fed has more breathing room. The SPY is back above support at $204 and we need to keep an eye on that level. Resistance is at $207.

China's trade numbers were a little soft over the weekend. I sense that credit concerns will resurface in coming weeks as the PBOC takes its foot off of the gas pedal.

The ECB fired a bazooka a few weeks ago and they don’t plan to ease for a while. They want to see if recent actions stimulate growth.

The market is addicted to easy money and central banks sparked the recent rally. Their tone is more hawkish and this will weigh on the market.

Earnings season is winding down and retailers will post this week. Oversaturation is a problem and there are too many stores. Discounts are deep and that will put pressure on profit margins. The news should have a negative bias.

Mega cap tech stocks typically excite investors. Q1 earnings disappointed and the QQQ has broken the 100 day and 200 day moving averages. It's hard to imagine that the market can rally without tech.

There are a few nagging issues that will also weigh on the market in coming weeks. Greece needs to secure financing and England could leave the EU (Brexit). Brazil is dealing with political corruption and credit issues. The turmoil will be on public display during the Olympics and less than half of the tickets have been sold.

I've been mentioning that the market will gradually drift lower in the next few weeks. I'm not expecting any sudden moves unless credit issues surface. Profit-taking will set in and the SPY should test $200. The move will be choppy with very little follow-through. Put buyers will have to be very patient and time decay will be an obstacle.

I am long VXX and BZQ. These are swing trades and they will give me some overnight bearish exposure.

I am also selling a few out of the money bearish call spreads. The short strike is above resistance and I am leaning on that level. If the stock rallies above technical resistance, I will buy back the spread.

The majority of my trading takes place in the first two hours and I am taking profits along the way. My overnight risk exposure is minimal.

If the S&P makes an overnight move of more than 10 points, I fade the early move. After the first hour, I take a more balanced approach and I use the first hour range as my guide. If the SPY is above it, I buy stocks with relative strength. If SPY is below the low of the first hour, I short stocks with relative weakness.

I am bearish on commodities, but the wildfires in Canada could keep oil above $45 for a while. This is a significant event and the disruption could last for months.

The news is fairly light this week and the action will dry up. Late day selling and a breach of $204 would be bearish and I will be more aggressive with shorts if this happens. Resistance is at SPY $207 and it should hold.

.

.

Daily Bulletin Continues...