News Vacuum Sucks the Life Out of the Market – Watch For Bearish Signs

Posted 9:30 AM ET - Yesterday was one of the slowest days I can remember. The range was tight and the volume was very low. We are in a news vacuum and we can expect more of the same.

Earnings season is winding down and retailers will post this week. Discounts are deep and that will hurt profit margins. These releases will have much of a market impact.

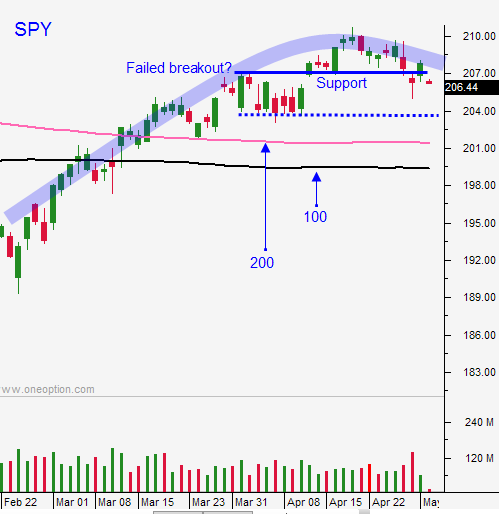

Support is at SPY $204 and resistance is at $207. There is a positive tone to the open and we could challenge $207 today. I don't believe we will get through it.

I have been making great money day trading and that is where my focus will remain. The market has no trend or momentum and swing trades are difficult. I am looking for bearish call spreads and I have a few on. I like to sell calls above resistance and if that resistance is breached, I buy back the spread. I distance myself from the action and I let time decay work its magic.

Late day selling will be a sign that sellers are gaining the upper hand. Higher opens and lower closes will also serve as a bearish warning sign. Until I see that price action, I will assume that we are going to chop around.

Central banks are taking their foot off of the gas and that should keep a lid on this rally. Earnings season has been underwhelming and tech stocks are weak. I still believe we will test SPY $200 in the next few weeks. We will see a couple of down days and a couple of up days. The down days will be bigger in magnitude than the up days and the market will drift lower.

Energy stocks will get a little pop from the fires in Canada. However, the rest of the basic materials sector looks like an excellent short. Emerging markets that have rallied recently will also experience profit-taking as central banks take their foot off the gas.

Day trading has worked extremely well and this is my bread and butter. Most days I am done after 2 hours of trading. If I start to see the warning signs I mentioned, I will buy some puts and hold them overnight. I am long VXX and BZQ so I do have some bearish overnight exposure.

Look for quiet day and watch for signs of late day selling.

.

.

Daily Bulletin Continues...