Low Volume Chop – Market Searching For Direction – Stick To Day Trading

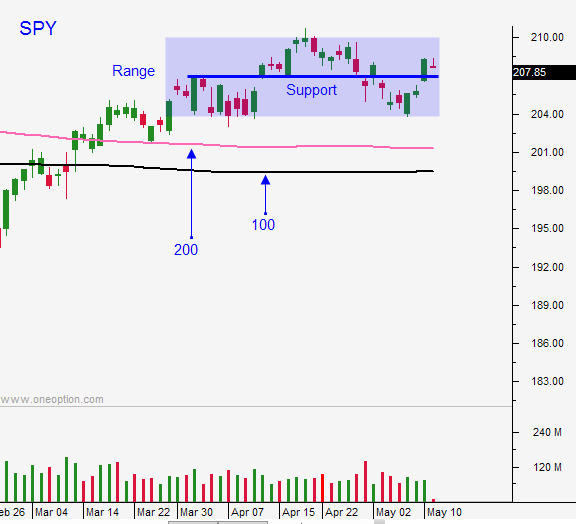

Posted 9:30 AM ET - Yesterday the market gapped higher and most of the action ended after the first hour of trading. Stocks gradually drifted higher on light volume. The SPY blew through resistance at $207 and that is now support.

The news is light this week and earnings season is winding down. China will post GDP/industrial production/retail sales over the weekend. Their numbers have improved slightly and the news should be market neutral.

Last Friday's soft jobs report has sparked a relief rally and the Fed is likely to push back their rate hike timetable. We won't know if labor growth is contracting for a few more weeks. One number does not make a trend.

Retailers are posting results this week and the news is discouraging. This sector will not lead the rally.

The market is pricing in Greek refinancing and there are rumblings that China might continue stimulus programs. These rumors are keeping a bid to the market.

We're in a news vacuum and we could be stuck in a range for another week or so.

I will be day trading both sides of the market and I will use the first hour range as my guide. You know from my comments that my overnight exposure is minimal. Yesterday’s rally was the type of noise I want to avoid.

Now that we have bounced, I will be selling a few more bearish call spreads.

If I see late day selling, I will buy puts when we close below SPY $207.

The market is probing for support this morning. Let's see if yesterday's gains hold up.

.

.

Daily Bulletin Continues...