Rally Will Run Out of Steam Today – Watch This Video On How To Fade the Market

EDUCATIONAL DAY TRADING VIDEO - HOW TO FADE THE MARKET

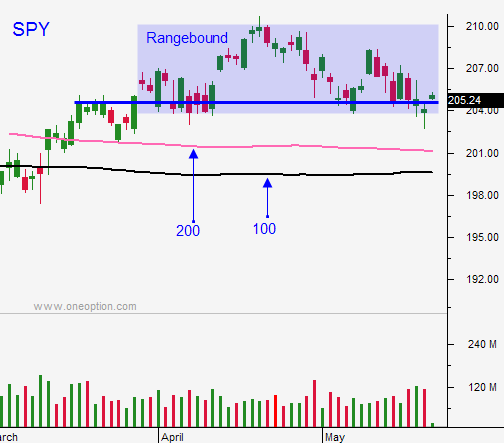

Posted 9:40 ET AM - Last Thursday the market breached major support at SPY $204. Yesterday, we broke through major resistance at $208 and we will challenge $210 this week. Profit-taking was not strong enough to push us lower last week and buyers stepped in with confidence once support held. We can expect whipsaws like this over the summer.

Greece secured its loan and this dark cloud has parted. Everyone expected them to reach a deal. Similarly, everyone expects the Fed to stay sidelined in June, but the news will come as a relief. Brexit is less certain and polls suggest that England will stay in the EU. This news would be bullish and we will find out in a month.

The market lacks a catalyst and it is searching for direction. We are trapped in a range and these moves are nothing but noise. One week traders are worried about a Fed rate hike and the next week they are pushing the timeline back.

The Fed will not hike in June because of uncertainty related to Brexit. They won't hike in July because labor conditions will still be soft. The market will decline in August/September so they won't hike during the September meeting. After that the November elections will be on our doorstep and they won't hike because they don't want to make this a political issue. The bottom line is that traders will continually worry about a rate hike and the Fed will have strong rhetoric, but no action. There will be plenty of reasons not to hike.

I'm trying not to read too much into any of these moves. I did buy a handful of puts last week and I took small losses on those positions. I closed out VXX for a scratch last week and I'm still long BZQ. This is a fairly large position for me and it has been excellent. Even with the market rally, Brazil is weak. I have very nice profits in this position and I will exit if BZQ retraces.

My focus has been on day trading. We are making fantastic money in the chat room. I have two searches (bullish and bearish) that nail trades. The top five on each list are ready to trade immediately. Traders in the chat room made a killing on the long side yesterday. I waited for the market to run out of steam and I went 5-0 on the short side with hefty winners.

After a 25 point rally yesterday, I believe the 10 point rally today will be a little stretched. The market will be getting close to major resistance at SPY $210 and I don't believe we will get through it this week.

I will trade from the long side early, but I will be watching for signs of exhaustion. I will trade from the short side when the market fails to advance and it starts to compress. I will be done trading after 3 hours.

Watch the video I recorded yesterday and you will get a feel for the way I trade market reversals.

Stick to day trading. There are great opportunities on both sides.

When the rally stalls, look for opportunities to short stocks with relative weakness. We are in pre-holiday mode and the action will slow down after a couple of hours of trading.

Make your money early and call it quits.

.

.

Daily Bulletin Continues...