Summer Doldrums – Market Bid Will Strengthen After FOMC Next Wed

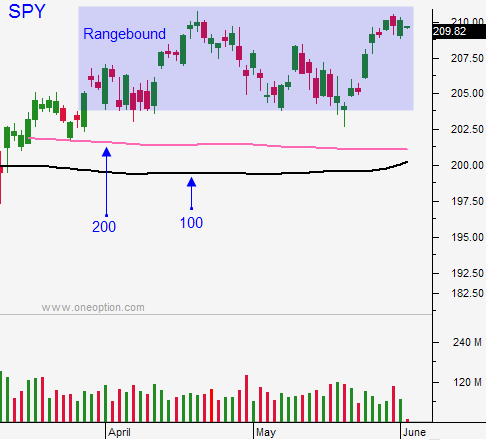

Posted 9:40 AM ET - I wish I had some exciting news for you, but I don't. The market is directionless and it's waiting for a catalyst.

ISM manufacturing was a little bit better than expected yesterday and official PMI's were in line. This morning ADP reported that 173,000 new jobs were created in the private sector during the month of May. That is a perfect number (not too hot and not too cold).

The Street is modeling for 160,000 new jobs tomorrow. It's typical to see an employment dip during the summer due to seasonal adjustments. A number in the range of 180,000 would be market friendly.

Even if the jobs report comes in hot (greater than 220,000) the FOMC will not hike. The Brexit decision is too close to call and a vote to leave the EU would result in a market decline and currency fluctuations. The Fed will wait for this to play out and when releases its statement next week, the market bid should strengthen.

The downside has been tested this week and we saw late day rallies both days. Trading volumes are light and we can expect the first hour range to hold.

I sold half of my BZQ yesterday and I am likely to sell the rest today. This is a big winning position for me and I want to lock in profits. When the Fed keeps rates unchanged it will be good for emerging markets. I am bearish on Brazil and I will look to re-enter this trade at a better level.

We've been making great money day trading a new system I released two weeks ago. I have an algorithm that scores day trading opportunities and the best rise to the top of the list. I've been focusing on the top five and it's been pretty easy to make money in a flat market. The top 5 stocks are ready to trade immediately and there's no need to change what's working. I have been making better money on the long side and that is what I will favor today.

Energy stocks look poised to roll over and oil is down today. I will be evaluating shorts in that sector.

Look for more range bound trading today. We might see a little movement tomorrow off of the jobs report.

.

.

Daily Bulletin Continues...