FOMC Reaction Will Be Bullish – Trade From the Long Side Today

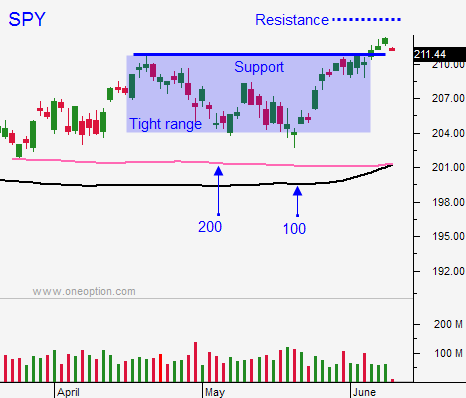

Posted 9:20 AM ET - The market has been trying to work off a light round of profit-taking the last few days. Support at SPY $207.50 was tested yesterday and it held. The FOMC will release its statement this afternoon and I'm expecting a bullish reaction.

Last month’s dismal jobs report and the threat of Brexit will tame the Fed’s tone. FOMC meetings have been bullish for years and after the recent pullback, we have a little room to the upside. Quadruple witching will "goose" the market and we should finish the week on a positive note.

Next week we will see some nervous jitters ahead of the Brexit vote. The results will not be known until Friday, June 24th.

If England remains in the EU, the market will challenge the all-time high and we could blow through it. If England leaves the EU, global markets will correct and the SPY could fall to $190.

This is a binary event and it is the biggest news of the summer. It will drive the price action for the next few weeks.

I day traded from the long side Tuesday and I had a fantastic day. I will trade from the long side again this morning. Relative strength is easy to spot.

After the first two hours of trading, I will take a break. The price action will slow down dramatically and the market will flat line.

I will be looking for strong stocks to buy and I might hold a couple of positions into the FOMC statement. My decision will depend on how far the market rallies before the announcement (I don’t want a big rally) and the quality of the candidates I find. If I do not hold over the news, I will have a handful of stocks loaded and ready. If the reaction is bullish (as I suspect) I will fire quickly.

This dip is a buying opportunity. Focus on the long side today. If the tone is particularly dovish, we should see follow-through buying overnight.

If by chance the reaction to the Fed is negative, use SPY $207.50 as your guide. I will short the S&P futures at that level and I will keep a tight stop. This scenario is fairly unlikely. I don't want to short individual stocks because I will be too spread out. I want to be able to get in and out very quickly if the decline does not hold.

I am bullish today and that is where I will spend my energy.

.

.

Daily Bulletin Continues...