Market Is Soft – Buyers Will Return After FOMC Minutes Today

Posted 9:30 AM ET - Yesterday the market slipped the entire day and it closed on the low. There was a small flight to safety (utilities, telecom and REITs) and that is not a good sign. We are seeing additional weakness this morning. The FOMC minutes later today should be dovish and the bid should firm up.

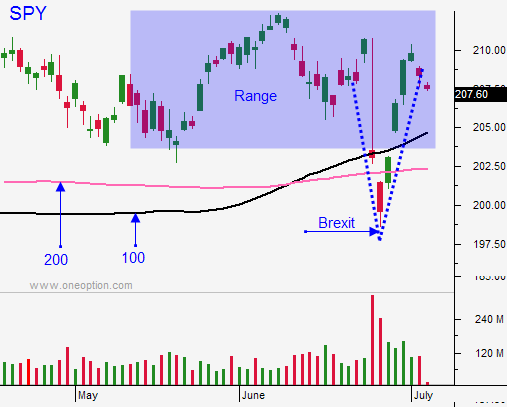

Brexit will weigh on the market longer-term. The EU is weaker without England and credit concerns in Italy are starting to surface. It will be a couple of years before England makes the break and many believe that the EU will negotiate terms to keep them in.

Russia is draining cash reserves due to low energy prices and Brazil is a mess. In recent years has been pretty typical to see credit concerns flare-up in August when politicians are on vacation.

Earnings season starts next week and the price action should be fairly positive until Apple announces on July 26th. I'm expecting sluggish profits in Q2. Corporate cash flows are decreasing and that is having an impact on buybacks. That has been market catalyst and we will not have it.

Let this early round of selling run its course. If we make a new low after the first hour of trading, favor the short side. Support should be established by mid-day and I am expecting a bounce after the FOMC minutes.

The market is trapped in a range and it lacks a catalyst. We will see choppy price action the rest of the summer. Profit-taking will be driven by credit concerns and buying will be driven by central bank money printing.

Favor the short side early today and prepare to shift to the long side this afternoon. Trading volumes are light so keep your size small.

.

.

Daily Bulletin Continues...