Market Will Breakout or Breakdown – Wait For Technical Confirmation

Posted 9:30 AM - September and October are traditionally my best months of the year. I look forward to getting out of the summer doldrums. The last month has been tough and flat markets are great for honing your skills. They require lots of patience. If you made money in August you are an excellent trader and when the volume returns it will be like shooting fish in a barrel.

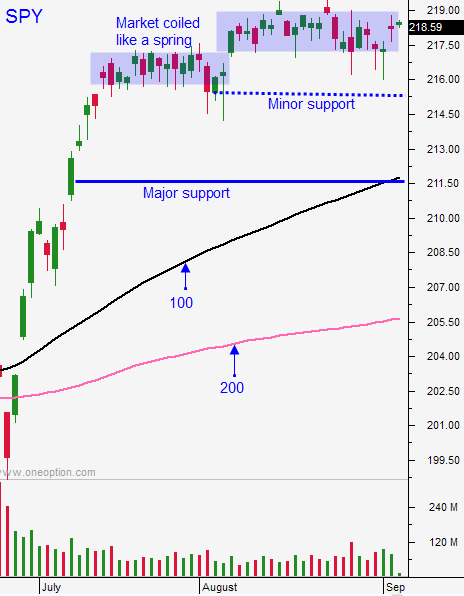

The market is coiled like a spring. The longer and tighter the range, the bigger the breakout. We still don't know which way the market will move so we have to wait for technical confirmation. Support is at SPY $215.5 and resistance is at the all-time high.

Option implied volatilities are near historic lows and traders are complacent. This is normally when you might see a correction.

Credit markets are stable and a crisis is the only thing that can lead to sustained selling. Since we do not have a credit crisis, I believe any decline will be a temporary and it will represent a buying opportunity.

Last week's soft jobs report (151 K) will keep the Fed sidelined during its next meeting in two weeks. It is possible that we will see a rate hike in December just like last year. I do not believe the Fed will hike before the election.

Polls are tightening and it is not a given that Hillary will win. The market hates uncertainty and the election could spark some volatility if the race tightens.

If the market breaks out to a new high, the upside is fairly limited. Stock valuations are stretched and domestic growth is slow. I believe a breakout would be fueled by short covering and I would be waiting to see if this is a blow-off top. Late day selling would be a warning sign and a reversal could result in a sharp drop below SPY $215.50. A possible December rate hike would prompt profit taking at the all-time high and this could be the catalyst for the drop.

This week the trading activity will gradually return. Today we will be nursing a hangover from a holiday weekend and I'm not looking for a big move.

ISM services will be posted 30 minutes after the open and the number should be in line.

I would prefer to see the market dropped to the 100-day MA. This would be the most tradable scenario and it would set up a nice little buying opportunity into year-end.

Watch for late day selling. That would be a warning sign especially if we see follow-through the next day.

My overnight risk exposure is as low as it's been all year. I own BZQ (bearish position) and this is a longer-term trade for me. Once we breakout/breakdown I will increase my size and I will take overnight swing positions.

Get your bearings and prepare for action.

I added a swing trading chat room last week so make sure to take the free trial.

.

.

Daily Bulletin Continues...