Market Liked the FOMC Statement – Here’s Why – Trade From the Long Side

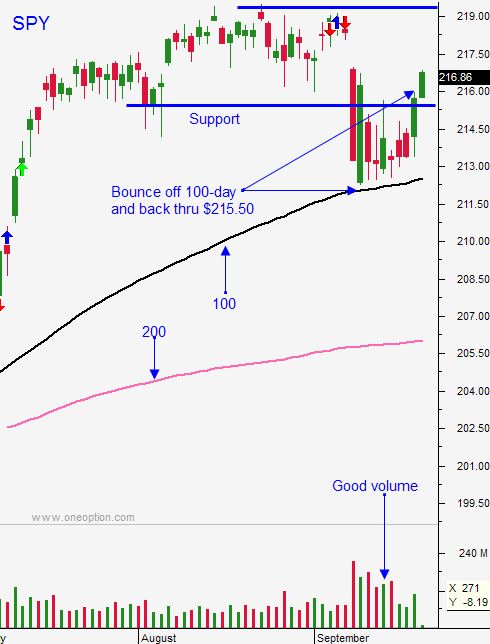

Posted 9:30 AM ET - Yesterday the FOMC stated that a rate hike this year is likely. Normally that would spark selling, but they tempered their comments by saying that future rate hikes would be gradual. Only two moves are projected next year. The market liked the longer-term dovish rhetoric and it rallied above resistance at SPY $215.50.

This morning we are seeing solid gains and this should be an excellent trading day. With the news behind us and some follow-through buying from yesterday, stocks should be able to grind higher today. We will lean on support at SPY $215.50. As long as we are above that level, trade from the long side.

The Fed also lowered its growth projection by .2%. There was complete dissension among officials with some wanting to keep rates unchanged through 2019 and others wanting to hike to 3 1/2% in that same timeframe. This could lead to some uncertainty in the future.

The rate hike this year should keep a lid on the rally and the highs should hold.

Unfortunately, the outcome from the FOMC meeting was the worst-case scenario for us. We needed a sharp decline down to the 200-day moving average. That would've set up an excellent year-end buying opportunity. Now we are likely to float higher and chop around while we wait for the November FOMC meeting.

Until we get a significant breakout from this range, I will stick to day trading. The market has no momentum and I can't justify taking overnight positions.

Today I will let the early rally establish itself. I want to make sure that the gains hold before I start buying stocks. Time will reveal the strongest stocks and if the rally holds I will start buying after 30 minutes.

The market tested the 100-day moving average a few times this month and it is rallying off of that level. We have follow-through today and I'm fairly certain that we should see a steady grind higher today.

Trade from the long side today and use SPY $215.50 as your guide.

.

.

Daily Bulletin Continues...