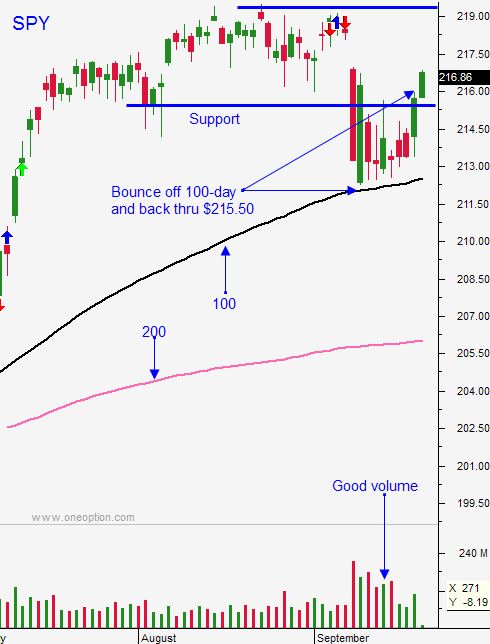

Market Action Not Indicative Of Strong Buying – Use SPY $215.50 As Your Guide

Posted 9:30 AM ET - The market rallied after the FOMC statement and it broke through resistance at SPY $215.50. Yesterday we saw follow-through buying and we can lean on $215.50 for support. I still don't trust this rally so I am only day trading from the long side - no overnights.

The Fed said that they will hike rates this year. They won't do it ahead of the election and that means a December move is likely. This is bearish news and I don't believe we will see a new high this year (unless it happens after the rate hike).

Traders took consolation in the dovish rhetoric for 2017. The Fed said that future moves will be more gradual than previously projected. That got bulls excited for a moment, but the reality is that the Fed can change its mind. This was simply their way of tempering the shock of a rate hike.

Donald Trump is closing in and the polls are tight. This is adding some uncertainty and market conditions should be choppy. The debate Monday evening will have an impact on the polls and consequently it could move the market.

Yesterday the market shot higher and it sat the rest of the day. The price action reminded me of the summer doldrums and the trading range was very tight. This is not the type of price action that indicates strong buying.

I won't aggressively trade this market until we get a decent pullback to the 200-day moving average. At that level I would feel confident getting long into year-end. If we never challenge that level and we just float around, my activity will be relatively small.

Earnings were okay and stocks are fully priced. Labor conditions are muddling along and economic growth is very sluggish. There aren't any credit issues and the market seems content where it is. We are in "wait-and-see mode". That means we will constantly be looking towards the next news event hoping that it might shed some light.

From a day trading perspective I will use the first hour range as my guide. If we are above the first hour high I will favor the long side. If we are below the first hour low I will favor the short side. If by chance the market trades in that range, I will trim my size and look for a few longs to trade. I will also only trade the first half of the day if conditions are quiet.

If the SPY closes below $215.50 I will buy puts for an overnight position.

.

.

Daily Bulletin Continues...