Earnings Releases Will Provide Some Action During A Quiet Week

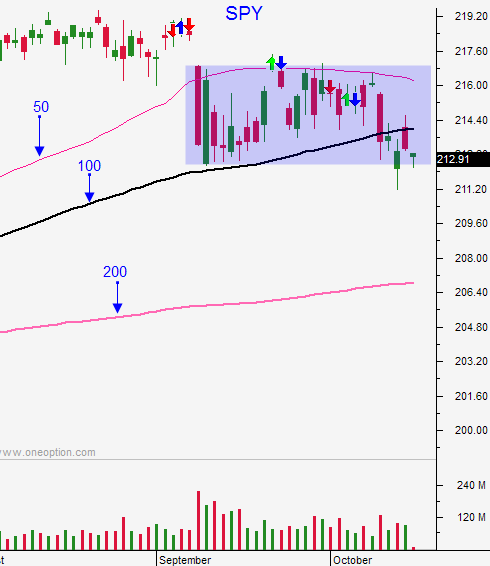

Posted 9:30 AM ET - The market is treading water right above the 100-day MA. One day it looks poised to bounce and the next day it looks ready to take out support

Earnings season will kick into high gear this week. IBM and NFLX post after the close today. GS, INTC, YHOO post after the close Tuesday. MSFT posts after the close Thursday. A week from now we will get AAPL and other mega cap tech stocks.

The market has no direction and traders are waiting for news events in hopes of a move in either direction. Until we have a technical breakdown with follow through selling and late day weakness, I won't take overnight shorts.

If the market drifts lower I will probably not get short overnight. A pre-hike market decline will be a buying opportunity especially if we get down to SPY $206.

Our only chance for decent trading into year-end was a drop to the 200-day MA. The chances of that happening are low now that seasonal weakness has passed. That drop to SPY $206 would have set up a nice year end bounce.

A December rate hike is very likely and now that the expectations are high, the Fed needs to just do it. We need this to shake up the market and to spark movement. With low rates and sluggish economic conditions, we will just chop around. Dips are buys because equities are attractive (aka Fed put). When the market rallies to the high we see profit taking because stocks are trading at a forward P/E of 17. These two forces are keeping us trapped in the range.

The November FOMC and the election are the next 2 big events.

This week we will try to nail some earnings plays. I am expecting a choppy week and $213 should hold.

.

.

Daily Bulletin Continues...