Mega Cap Tech Earnings Will Attract Buyers – Sell OTM Bullish Put Spreads

Posted 9:30 AM ET - We are getting a nice little bounce on the open this morning. Analysts believe that the Fed has some breathing room after a soft employment report and the likelihood of a December rate hike is 66%. Earnings season is upon us and mega cap tech stocks will release earnings over the next week. That is a bullish influence.

Netflix posted strong number and that has tech moving higher this morning. Intel will report after the close and it will set the tone for semi-conductors. Microsoft posts after the close on Thursday and it will also shed light on the tech sector.

The market is directionless and the intraday price action is lackluster. We might see a grind higher to the upper end of the range in October, but I'm not looking for a breakout. The November FOMC and the election will keep a lid on the rally.

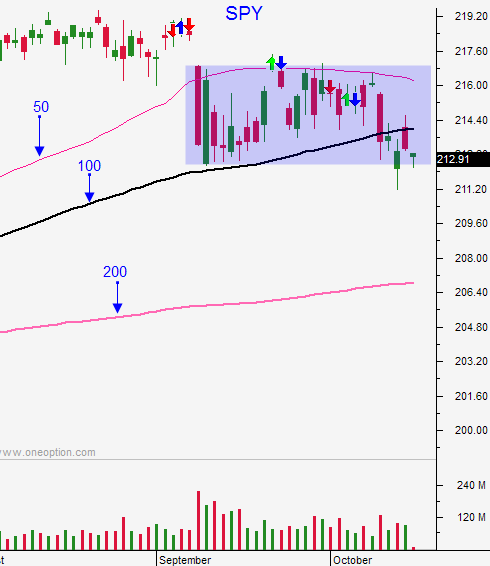

This is an excellent opportunity to sell bullish put spreads. Distance yourself from the action and make sure that technical support lies between the short strike price and the stock price. If the stock breaches technical support, buy back the put spread. This strategy takes advantage of time decay and I believe support at SPY $213 will hold while we are waiting for the next news event.

I continue to day trade and my overnight positions are small.

Up opens are difficult to trade. I have some stocks that I've been watching for the last few days and I will be on those early. I will also be looking for new stock candidates, but I need to see relative strength after the first hour of trading. I want to make sure that this market rally is for real. When the market dips relative strength is much easier to spot. Any market dip or compression will provide a nice entry point.

Use the 100-day moving average as your guide. If we are above it you can get long with confidence.

A close above SPY $214 would attract buyers the rest of the week.

Trading in a directionless market is like trying to fly a kite with no wind. Set passive targets and take what the market gives you.

There will be individual stock opportunities now that earnings season is unfolding.

.

.

Daily Bulletin Continues...