FOMC Will Provide A Headwind – Buy Dips and Keep Scaling In

Posted 9:30 AM ET - Wednesday the market surged to a record high and yesterday it took a breather. The S&P 500 is flat before the open today and Asset Managers are likely to wait for the FOMC statement next week before they buy. Earnings season is in high gear and the early results are good.

Google, Microsoft and Intel posted after the close yesterday. Google's revenues beat expectations, but they missed on the bottom line. Microsoft had a solid beat and Intel's guidance was good. Mega cap tech will set the tone and “so far so good”. Financials also look good.

The promise of lower corporate taxes and reduced business regulation will keep Q1 guidance upbeat as more companies release earnings.

The Fed is worried about fiscal stimulus and that might prompt them to hike sooner than June. This is the only potential speed bump and a "balanced" statement next week would suggest a wait-and-see approach. I believe this scenario is likely and the market will rally.

GDP came in at 1.9% and that is a little shy of expectations. Durable goods were down .4% versus expectations of a 3% increase, but this is a volatile number. Global economic data points have been encouraging and we are seeing an uptick in activity.

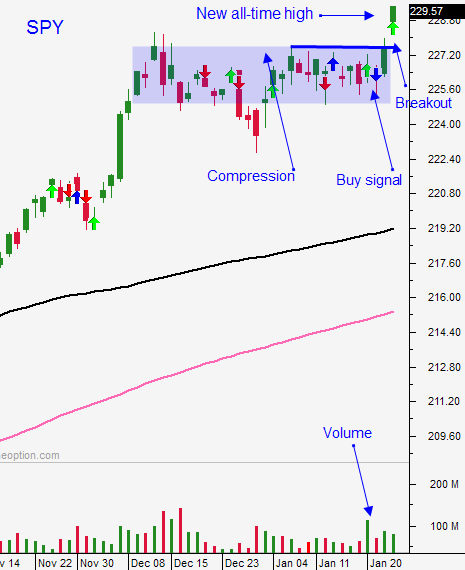

We've been waiting for a breakout and we have one. Long tight ranges produce sustained breakouts and this move is just getting started.

Swing traders should buy calls on stocks that are breaking through horizontal resistance on good volume after reporting earnings. Scale into positions and know that you might face some nervous trading ahead of the FOMC statement next Wednesday. Any dip will be brief and shallow and it will represent a buying opportunity.

Day traders need to wait for a market move today. We need to gauge the strength of the first move (higher or lower) before we enter trades. The market could swing either way after a huge rally.

If you resisted the temptation to get long early yesterday you were rewarded. If the market probes for support I want to see that move stall before I start scaling into long positions. Support is at SPY $228.60. That was the opening price on Wednesday and we want to see that level hold. There is also minor support at SPY $229 (the low from Thursday). If the market can't challenge these levels in the first hour of trading I will feel comfortable scaling into long positions. If either of these two levels fails, we need to be patient. I am not going to short this rally so I will either be in cash or I will be scaling into long positions.

If the market starts to grind higher and we are above $229.60 (all-time high) I will aggressively trade from the long side. I don't expect this ahead of the FOMC statement. I believe that the market will tread water until next Wednesday.

You should have long positions and you should be looking for opportunities to add. We will see some nervous jitters and the market will be able to shake them off next week. Strong earnings, improving economic activity and a "balanced" Fed statement will attract buyers.

Stay long.

.

.

Daily Bulletin Continues...