Market Will Drop To the 100-day MA – More Selling Into June FOMC

Posted 9:30 AM - Yesterday the S&P 500 dropped 18 points on the open. This sparked profit-taking and bullish speculators frantically exited positions. Once the momentum was established the market never recovered. Stocks closed on the low of the day and we are seeing follow-through selling this morning.

Warning signs have been present for the last week and I've been telling you that this any surprise favored the downside.

Earnings season attracts buyers and the strongest companies announce early in the cycle. Once mega cap tech stocks post results the air is let out of the balloon. The last leg of this rally was narrowly confined to tech stocks and that is not a healthy sign. In the last few days we've seen "dogs" like Twitter, Yahoo and BlackBerry rally. In my day trading chat room I pointed that out. When the “dogs start barking” you know you are close to the end. Financial stocks have not participated and apart from tech there is no leadership.

Economic growth is moderating and investors fear that the Fed might be too aggressive in their tightening. They cited stronger growth in Q2 and that tells me they want to hike in June. If the market continues to drop they will reconsider. I believe the threat of another rate hike is what sparked profit-taking (and bullish speculation).

Good news was priced into the market and investors were counting on tax cuts. The healthcare bill will stall in Congress and politicians are less productive during the summer (it’s hard to imagine it can get any lower).

I've been pointing out that Global Asset Managers have reduced US holdings to their lowest level in nine years. Outflows have exceeded $22 billion in recent weeks.

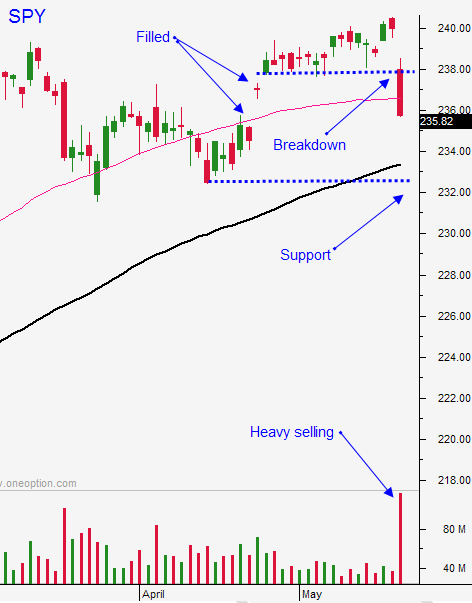

The market needs to go back and fill in recent gaps. As I stated earlier in the week I believe the 100-day moving average will be tested.

Swing traders should have bought some puts on the SPY Wednesday. We are going to see selling on the open. Place your stop above your entry price and don't let this trade turn into a loser. As the market declines trail your stop. The long-term trend still points higher and short positions need to be handled with care. As far as I'm concerned this round of selling will ultimately result in an excellent buying opportunity. Passive traders should wait patiently in cash until support is established. Once that happens there will be an excellent opportunity to sell out of the money bullish put spreads. There will also be opportunities to buy calls.

Day traders need to watch the early action. All of the minor support levels were breached yesterday and $233.40 is the next one to watch. Resistance is at the 50-day moving average ($236.65). I believe the decline is a bit overdone and I will be watching tech "darlings" to see if there is a bid. Ideally the market will probe for support and these stocks will tread water. That will be a sign of relative strength and they will run when the market finds support. I'm not overly interested in playing the short side from a day trading standpoint. Heavy selling yesterday followed by a lower open spells danger for shorts. Stocks that look extremely weak have the potential to reverse quickly and I don't like the risk profile on the short side today.

Look for additional selling the next two weeks. The FOMC minutes next Wednesday will be very important.

Don't let that SPY put trade turn into a loser!

.

.

Daily Bulletin Continues...