Market Will Tread Water Next Week – More Selling After Memorial Day

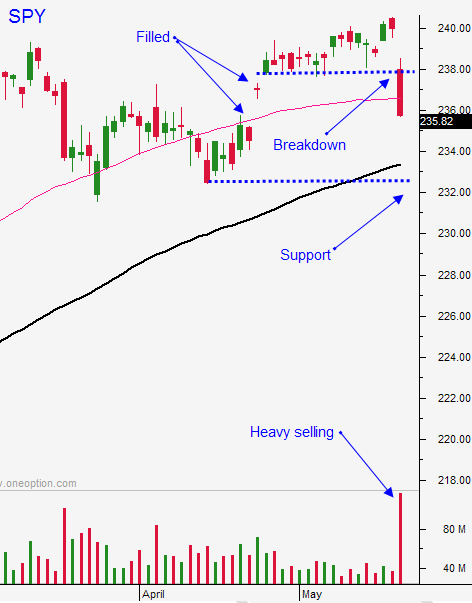

Posted 9:00 AM ET - This week the market showed signs of strain. The S&P 500 pulled back sharply from its all-time high on Wednesday. Bullish speculators hit the panic button and Asset Managers pulled bids once the momentum was established. Stocks are poised to open higher this morning but we will see more profit-taking in the next few weeks.

A combination of events sparked selling. Earnings season is over, growth is moderating, the Fed has its foot on the brake and Trump is sinking into "the swamp". Global Asset Managers are pulling money out of US equities ($22 billion in April) and that number will be even higher in May.

The FOMC minutes next Wednesday could be hawkish. Fed officials cited seasonal weakness and stronger growth in Q2. They want to raise rates and the recent market rally has provided them with a window of opportunity.

Next week we will be in pre-holiday mode. The action will taper off and stocks should be able to tread water.

Swing traders should have stopped out of the SPY puts yesterday for profit. This is a good opportunity to sell out of the money bullish put spreads. I would put some positions on today, but don't go crazy. Energy stocks are finding support and they are attractive candidates. Time decay will work its magic over the holiday and you can buy back your put spreads for profit after Memorial Day. We should see another wave of selling ahead of the FOMC statement in three weeks.

Day traders need to make sure the early rally holds today. Buy tech stocks if the market grinds higher. When the rally stalls take profits and watch for selling. I believe there will be a shorting opportunity mid-morning.

We won't see a meaningful rally until the downside is tested. I like financials stocks on the short side. Use the first hour range as your guide. Support is at SPY $236.50 and resistance is at $238 and $239.

The market will try to recover some of its losses next week, but the headwinds will blow. Stocks should tread water ahead of the holiday and the next wave of selling will come after Memorial Day.

.

.

Daily Bulletin Continues...