Market Will Tread Water This Week On Light Volume – FOMC Minutes On Wed

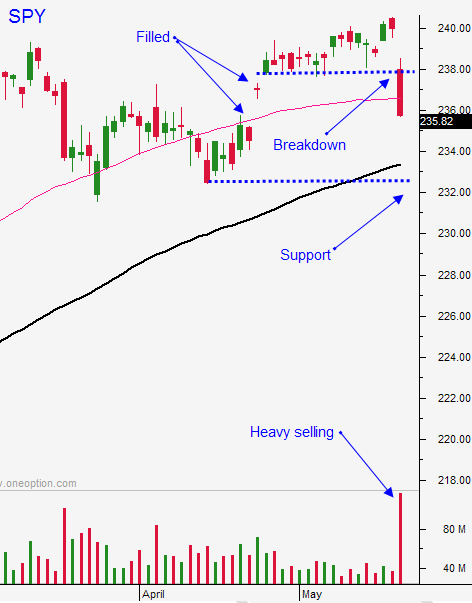

Posted 9:00 AM ET - Last week the market backed off from its highs and it filled in the gaps from three weeks ago. Prices stabilized Thursday and Friday and major technical support levels are still intact. Trading activity will decline ahead of Memorial Day and holidays typically have a bullish bias. The key event this week will be the FOMC minutes on Wednesday.

Economic growth is moderating and flash PMI's will be released Wednesday. The Fed has an aggressive tightening agenda and it's important that the numbers come in strong.

Trump's budget will be released this week. It will get plenty of attention, but I don't view this as a market moving event. We can expect plenty of media criticism.

Swing traders should sell out of the money bullish put spreads. Distance yourself from the action and make sure that technical support lies between the stock price and the short strike. If technical support is breached, buy back the put spread. This strategy will take advantage of the underlying market bid and time decay. If the SPY closes below $236.50 buy back your spreads. This could happen if the Fed minutes are hawkish.

Day traders should expect a fairly quiet week. Reduce your trade count and your size. Use the first hour range as your guide.

Technical support is at $236.50 and $238. Resistance is at the all-time high.

After Memorial Day we can expect another round of selling ahead of the June FOMC meeting. I still believe the 100-day moving average will be tested in the next few weeks.

.

.

Daily Bulletin Continues...