Fed Will Hike In A Week – Look For Nervous Trading and Tight Ranges

Posted 9:20 AM ET - The news is light and so is the volume. Momentum is all traders have to lean on. The FOMC statement will be released a week from tomorrow and we can expect dull trading until then.

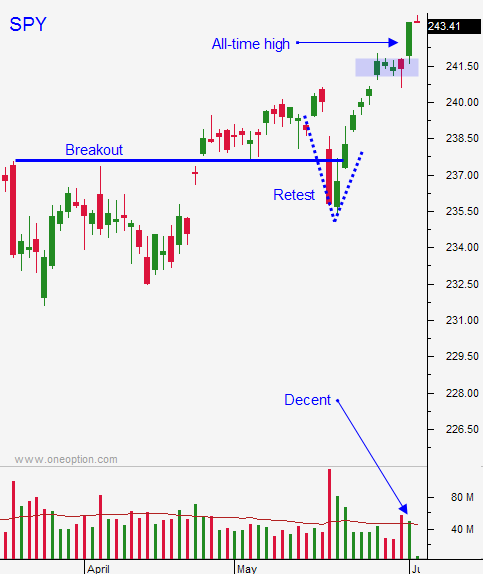

The S&P 500 was trapped in a three-point range yesterday. Day traders need to be very cautious. If the market can't breakout of the first hour range, consider taking the day off. I like down opens and I will be inclined to trade from the long side today once support is established. I will use $243 as my guide and that is the first level of support.

Swing traders should stay sidelined until the FOMC meeting. The Fed will raise rates and we should see nervous price action ahead of the statement. If the market can shoulder this round of tightening (the breakout holds) I will be more receptive to overnight longs.

I feel the last leg of this rally is "fluffy". Economic growth is moderating, trading volume has been light and the rally has been narrowly confined to tech. Politicians will take time off this summer and investors will grow impatient waiting for tax reform.

This round of tightening might temporarily be shouldered, but we will see profit-taking if economic conditions stumble. I would like to see a pullback to the 100-day moving average. That will flush out bullish speculators and it will establish a bona fide support level that we can lean on. Until we get that washout I will keep my trading activity at a low level.

Watch for late day selling and follow through the next morning. These would be warning signs. Trading ranges will be tight and we can expect a little nervousness ahead of the FOMC next week.

.

.

Daily Bulletin Continues...