Nervous Market Ahead – Watch For More Profit Taking In Mega Cap Tech

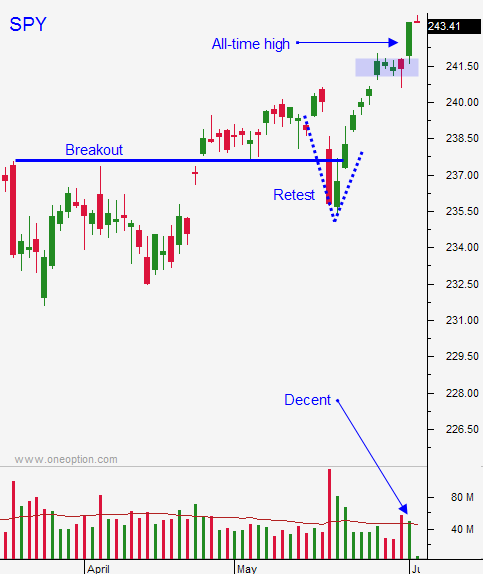

Posted 10:20 AM ET - Yesterday stocks took a breather and the S&P 500 traded in a narrow three-point range most of the day. I mentioned in my comments that we would see nervous price action and a late round of selling surfaced. Mega cap tech stocks dropped quickly and the QQQ was weak relative to the SPY. Support at SPY $243 held and it will be tested today.

Lackluster economic data points are making investors nervous ahead of next week's FOMC statement. The Fed will capitalize on the recent market rally and they will hike.

Politicians will take time off this summer and tax reform will have to wait a few months. Investors will grow impatient with “the swamp”. I don't believe the Comey testimony will yield anything new. The media will blow it out of proportion as they do, but it is one person's word against the other.

Swing traders should stay in cash until the FOMC statement. If the market can shoulder the rate hike I will consider taking overnight long positions. The breakout needs to hold and I need to see steady conditions with follow through. In particular I would like to see a pattern where the market opens on the low and closes on the high. I would also like to see participation from energy and financials. My swing trading longs will be relatively passive. I won't allocate much to swing trades until the market pulls back to the 100-day MA.

Day traders need to be patient on the open today. The wave of selling yesterday afternoon suggests that we could see more profit-taking today. At very least I expect SPY $243 to be tested. The next support level is SPY $242. Stocks that have recently surged will be hit the hardest. I'm not looking for a major decline, just nervous trading. Once support is established I plan to trade from the long side. The market momentum still points higher. If I do day trade from the short side I will use the S&P futures. I do this so that I can get in and out easily. That is not possible if I am spread out across many stocks. Playing the short side is very tricky and I don't suggest it unless the SPY is below $242.

Look for another quiet day. The range will be tight and the volume will be light. Keep your size small and try to find a few good trades. In the last 45 trading days we have only had 6 days where the market volume was greater than the 20-day moving average. These are very tough conditions.

.

.

Daily Bulletin Continues...