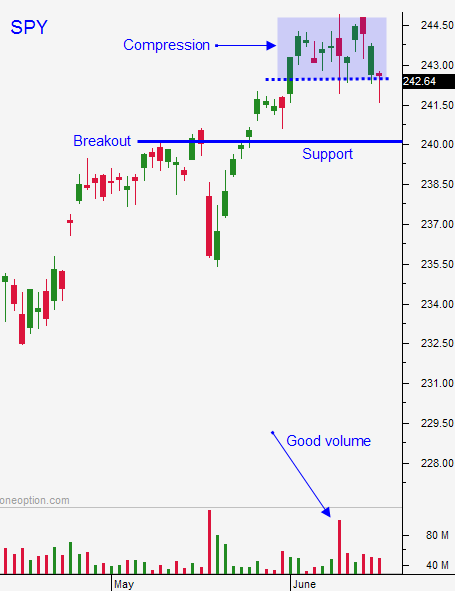

Buyers Will Maintain Market Support – Action Will Be Choppy

Posted 9:00 AM ET - The market is treading water near the all-time high and the price action is choppy. We are in a news vacuum and traders are waiting for the next catalyst.

Overseas markets were a little soft and oil prices have been declining.

Swing traders should be focused on selling bullish put spreads. If you don't have all of your positions on, don’t wait. You should be managing profits at this stage. Your short strike price should be below technical support and if that support is breached you should buy back your put spreads. As long as the stock maintains that level, let time decay work its magic. We are likely to see choppy action, but support will hold. Earnings season is a few weeks away and buyers will remain engaged.

Momentum favors the upside and there is not any news to stand in the way the next two weeks.

Day traders need to let the early action play out. Wait for a direction to be established and use the first hour range as your guide. If we are above it, favor the long side. If we are below the first hour low, favor the short side. Once the momentum is established the market has a tendency to continue in that direction.

The overnight action has been pretty weak. The S&P 500 rallied off of the lows and it looks like we're in for a flat open. I suspect the downside will be tested early. If support holds I will be looking for opportunities to get long. Tech stocks are finding support and they have upside potential.

Support is at SPY $243, $242 and $240.

Look for quiet trading with an upward bias the rest of the week.

.

.

Daily Bulletin Continues...