Flat Market Will Continue – Good For Option Sellers

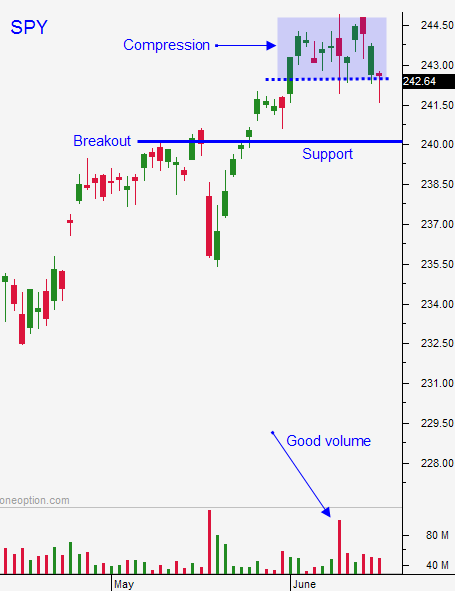

Posted 9:30 AM ET - The market is treading water near the all-time high and the summer doldrums have set in. We are in a news vacuum and there aren't any catalysts. We can expect choppy price action for the next two weeks and prices will firm up ahead of earnings season.

I mentioned this would happen after the FOMC meeting and swing traders should have bullish put spreads on. Time decay is working its magic and your stop should be below technical support. If that support is breached, buy back your put spreads.

Day traders need to tread cautiously. Wait for the market to establish a direction and gauge the strength of that move. If it is brief and shallow prices are likely to reverse. It is important to identify sectors with relative strength/weakness. Biotech has been hot recently and pharmaceutical stocks had a good day Thursday. We are seeing some rotation – lean on it and set passive targets.

Technical support is at $243, $242 and $240. Resistance is at the all-time high.

Expect tight trading ranges and choppy action. If the first hour range is breached, trade and that direction.

Keep your size small and your trade count low. We are in for a quiet one.

.

.

Daily Bulletin Continues...