FOMC Minutes Could Attract Buyers – Tech Will Stabilize This Week

Posted 9:00 AM ET - In the last week we've seen sector rotation. Q2 window dressing was in play and tech stocks were beaten down. The QQQ is within striking distance of the 100-day moving average. As earnings season approaches support will be tested and it will hold. Financials and basic materials stocks have been moving higher so the S&P 500 is been able to tread water.

This afternoon the FOMC minutes will be released. Traders will gauge the timeline for the next rate hike. I believe the comments will be relatively dovish since half of the Fed officials don't believe there will be another rate hike this year. We should see a little bounce on the news.

ADP will be posted tomorrow. We should see a number in the 200K range. That would be market neutral. Analysts are expecting the Unemployment Report to hit 190K on Friday. This would also be a market neutral event.

Swing traders should maintain stops on bullish put spreads. If you avoided tech stocks you are in good shape since the S&P 500 has been steady. Time will be working in your favor this week and the market should stabilize. We are only a week away from earnings season and that will attract buyers.

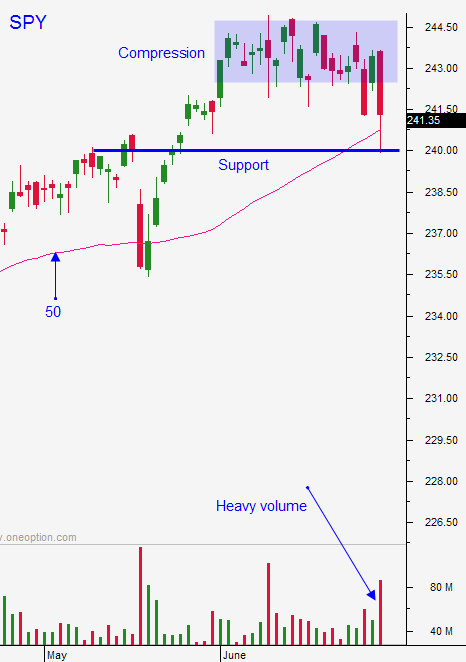

Day traders need to be very cautious this morning. The market is still suffering from a holiday hangover and the volume will be light. Use the first hour range as your guide. Support is at SPY $240 and $242 with resistance at $243. Support is at $135 and resistance is at $138 and $139.50 on QQQ. Look for choppy trading early in the day and the possibility of a nice little run after the FOMC minutes.

Now that the quarter is over I am expecting less sector rotation. Tech stocks should regain their footing next week.

.

.

Daily Bulletin Continues...