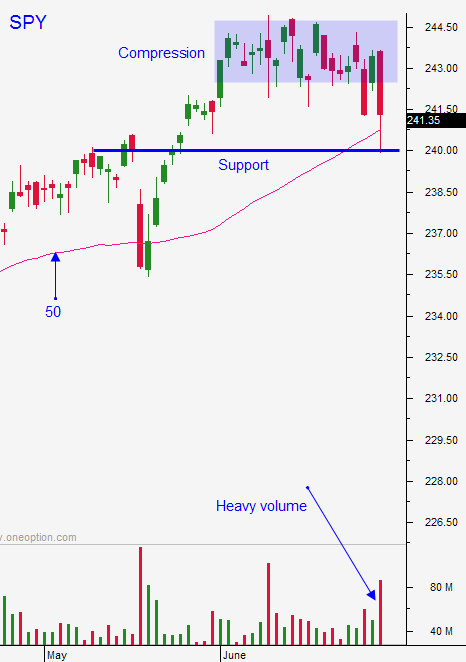

Major Support At SPY $240 – Use That As Your Guide

Posted 9:20 AM - Yesterday we saw a heavy wave of selling. Profit-taking in tech stocks spilled over to the S&P 500. QQQ breached key technical support levels and we can expect more weakness.

Support at QQQ $139.50 failed easily and major horizontal support at $138 also failed. The next support level is $136 and then the 100-day MA at $134.80. The S&P 500 has major technical support at $240. That is the 50-day moving average and it is the breakout from May. It touched that support briefly and the market bounced. SPY resistance is at $242 and $243.

This morning we are seeing a small bounce. I don't believe we will get a meaningful rally until the downside is tested once more. That dip will represent a buying opportunity if it is brief and if the market snaps right back. If stocks continue to drift lower it will be a sign that more profit taking lies ahead.

Swing traders should have bought back any put spreads once the stock breached technical support. This would've been likely if you sold put spreads on tech stocks. If you sold put spreads on industrials, healthcare, energy or financials you should be in good shape.

Day traders should use the first hour range as your guide. If you did that yesterday you made money on the short side. Once the selling momentum started it was pretty obvious we were headed lower. I did not catch that move. I kept waiting for support and it never surfaced. Once I missed the initial drop I stayed sidelined. I knew that eventually a low would be established and that a bounce would present a buying opportunity. I did make money late in the day when stocks rebounded, but I spent most of my time watching from the sidelines. I bought financials and the S&P futures.

Trading activity will subside. There isn't any news until the FOMC minutes next Wednesday. I'm expecting an early move today and then the action should subside.

I believe that once the downside is tested today we will see a decent rebound and prices will stabilize. Use the technical levels I've outlined as your guideline.

I will not be publishing market comments Monday. Most traders will take the day off and it should be one of the lowest volume days of the year.

Be safe as you celebrate the independence our great country.

Happy Fourth of July!

.

.

Daily Bulletin Continues...