Market In A Funk – Selling Pressure Will Build After Labor Day

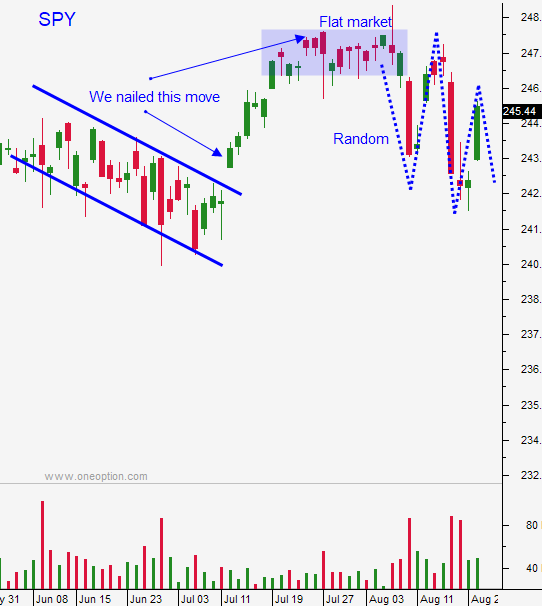

Posted 9:20 AM ET - Yesterday the market rebounded and today half of those gains will be erased on the open. The price action is very choppy and it will remain that way through Labor Day. This is a low probability trading environment for swing traders but it is is ideal for day traders. Just follow the early momentum.

I took profits on my short positions on the open yesterday. I day traded from the long side once we are above SPY $243.80. That is now a support level and we can use it as a guide. If the selling momentum drops us below that level I will focus on the short side today. Otherwise I will lean on that support and trade from the long side.

Swing traders should stay sidelined. Hope for a nice big correction in the next month. If we get one it will set up a fantastic buying opportunity this fall – one that you can load up on.

Trump is grabbing the headlines and his rally last night is being blamed for the decline this morning. He threatened a government shutdown (debt ceiling) if money was not appropriated to build "the wall". He also mentioned pulling out of NAFTA. This is just his way of negotiating and no one believes this will come to fruition.

Analysts believe that Yellen could provide some hawkish comments in Jackson Hole this week. A Fed Official (Dudley) referenced easier credit conditions in an interview and the need for tightening. I personally believe that the Fed wants to tighten as aggressively as possible and as long as the market is shouldering the rate hikes it will continue.

The debt ceiling will be a battle, but not because of “the wall”. Republicans and Democrats can’t agree on anything and it will go down to the wire. This will make investors very nervous.

Bull markets die hard and this one is in its ninth year. Trading from the short side is extremely difficult and snap-back rallies like the one we saw yesterday can be lethal. Reduce your size when you're trading from the short side and holding overnight positions. Increase your size when you are playing bounces knowing that the wind is at your back.

Resistance is at SPY $246 and support is at $243.80. Use those levels as your guide.

I am going to wait for support and I am likely to trade from the long side today.

A major holiday is approaching and the action will slow down next week.

.

.

Daily Bulletin Continues...