Make Your Money Early and Call It A Day – Watch the First Hour Range

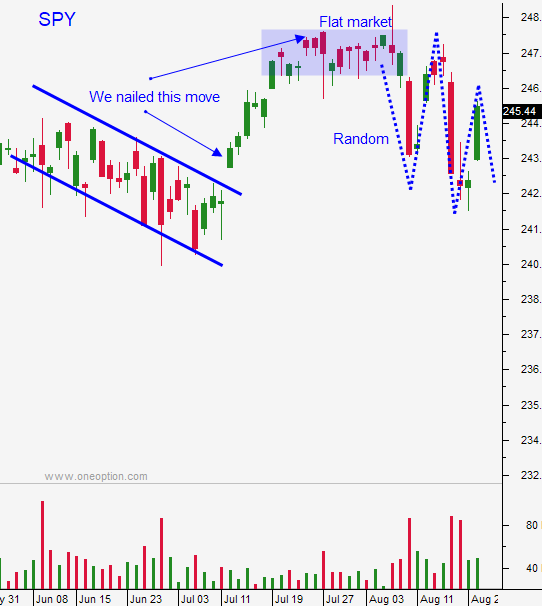

Posted 9:00 AM ET - Trading conditions remain choppy and the market is right in the middle of its two week range. There are not any significant news events to drive the action and to make matters worse a major holiday is approaching. Use support at SPY $243.80 and resistance at $246 as your guide.

Janet Yellen will speak in Jackson Hole, but don't expect any fireworks. The statement will be fairly hawkish (expected) and she will reiterate the need to reduce the Fed’s balance sheet starting in September. A December rate hike is expected and her comments will be consistent with that timeline.

Swing traders should stay sidelined. The market has no trend and the price action is random. I expect to see selling pressure just before the September FOMC meeting. That profit-taking will last until the debt ceiling is extended. A nice correction would set-up a great buying opportunity.

Day traders should use the first hour range as a guide. If we are above the high, focus on the long side. If we are below the low, focus on the short side. If we are trapped in the range, take the day off.

I have been able to find a few day trades early in the morning. I've been setting passive targets and calling it a day once the market settles in. The market compresses midmorning and I set alarms above the high and the low. If something happens I can always jump in.

Reduce your size and activity in this low probability environment. Expect random chop through Labor Day.

Keep you powder dry and know that the best part of the trading year is right around the corner.

.

.

Daily Bulletin Continues...