Market Doldrums Are Almost Over – Get Ready For Action

Posted 9:30 AM ET -

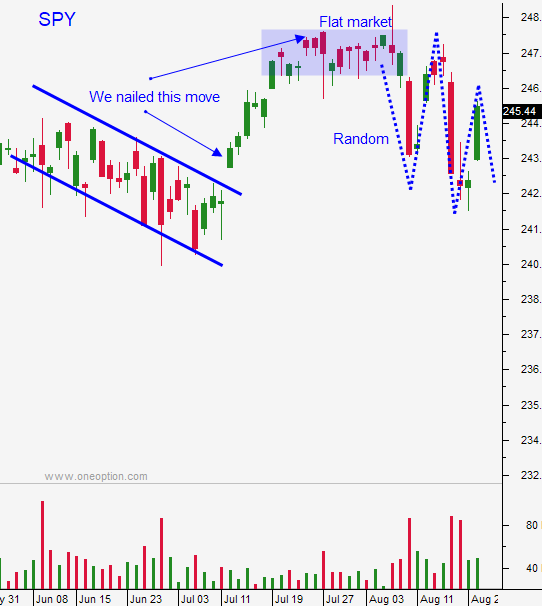

Three weeks ago the market was trapped in a tight range near the all-time high. Two weeks ago support was breached and we had a series of random gaps in both directions. Last week the market started to settle down and we are likely to trade in a tight range this week. A major holiday is approaching and the volume will decline.

The news is light on all fronts (political, economic, earnings and interest rates).

Swing traders should stay sidelined until we get a nice pullback. We could see that in a few weeks when the FOMC releases its statement. By that time the debt ceiling will also be upon us and politicians will be playing "chicken". Any pullback greater than 5% will represent an excellent buying opportunity.

Day traders need to trim their size and activity this week. I suggest calling it a day if the market can't get out of the first hour range. If the market is above the first hour high, focus on the long side. If the market is below the first hour low, focus on the short side. Set passive targets. Support is at SPY $243.80 and resistance is at SPY $246.

Successful traders will keep their powder dry in this is low probability trading environment. The market has no pace and the intraday moves are random.

The good news is that we're almost through the summer doldrums. My favorite stretch (mid-September through mid-November) is right around the corner. Preserve capital and get ready for action.

.

.

Daily Bulletin Continues...