Buy Puts – Dark Clouds Are Rolling In – Use This Level As A Guide

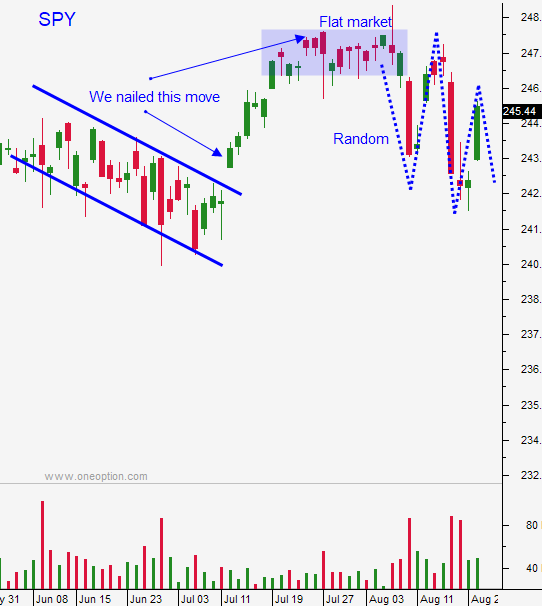

Posted 9:20 AM ET - In the absence of other news the market will focus on North Korea's missile launch and the devastation in Houston. Stocks are poised to open lower and the SPY will breach a minor support level at $243.80. We've seen profit-taking in the last two weeks and this move could gain traction.

The FOMC meeting in September will be on our doorstep when we return from Labor Day. The Fed wants to tighten. Soon after the FOMC statement, our nation will hit the debt ceiling. Politicians will play "chicken". They will threaten to shut down the government if they don't get what they want and the resolution will come down to the wire.

I see more negatives than positives at this juncture and my bias is bearish.

Aggressive swing traders who can watch the market should buy puts when the SPY falls below $243.80. Use a close above that level as your stop. Passive swing traders who can't watch the market should stay sidelined. Shorting a nine year bull market at the all-time high is risky.

Day traders need to be patient on the open. Wait for any bounce and get short. Use SPY $243.80 as your stop intraday. Support is at $242.20 (Low from 2 weeks ago). That is just above the 100-day moving average ($242) and that level should be "sticky". The next support level below it is $240.

If we close below the 100-day moving average I will hold some puts overnight.

.

.

Daily Bulletin Continues...