Market Action Will Pick Up Soon – Wait For It To Pick A Direction

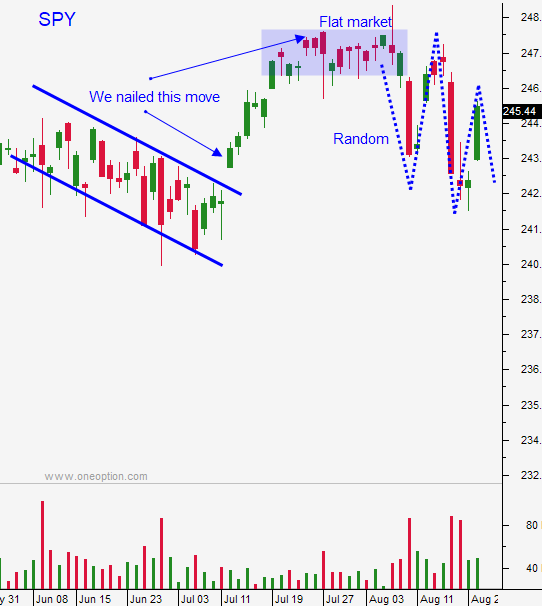

Posted 9:30 AM ET - Yesterday the market reacted negatively to the North Korean missile launch over Japan. Stocks made an early low and support at SPY $243.80 was breached. The market bounced off of the low and it spent the rest of the day grinding higher. If Asset Managers were in "risk off" mode we would've seen more pronounced selling. Instead, the price action suggests that the bid is still strong.

We've seen profit-taking in the last two weeks and the moves never gained traction. In each instance the declines were one day events.

The news is extremely quiet on all fronts.

Swing traders should keep their powder dry. The action will pick up in a couple of weeks and the market will pick a direction.

Day traders need to use key support/resistance levels as a guide. I went short yesterday when the market rallied to SPY $243.80. It paused there for 30 minutes and when it broke out I covered my short for a relatively small loss. The rest of the day I traded from the long side. Day traders have the ability to quickly adjust their bias and that is critical in this directionless market. Support is at SPY $243.80 and resistance is at $246. You can also use the first hour range as your guide. If we can't get out of the first hour range I will not be trading.

Trim your size and set passive targets.

The market has been on both sides this morning and we can expect a choppy day. I still have a bearish bias and I'll be looking for signs of weakness. Late day selling with follow through the next day would spark my interest especially if technical support is breached.

The doldrums will end in a week and the action will pick up. Be patient, we are close to better trading.

.

.

Daily Bulletin Continues...