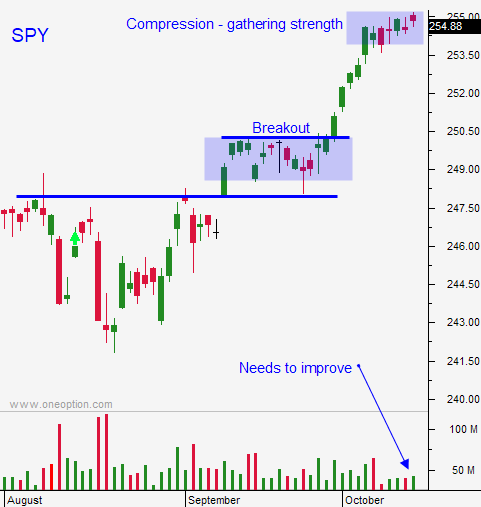

Buy Calls – Market Is Ready To Run – Earnings Will Be Good

Posted 9:30 AM ET - The market has had time to gather strength after the last run. It is inching higher each day and earnings season should provide a nice tailwind. Financial stocks are moving higher after solid earnings and mega cap tech stocks are on deck. With each passing day the likelihood of a big move higher increases.

Q3 earnings guidance was the strongest we've seen in five years and the results should be good.

China's imports were better-than-expected last week and that is fueling a rally in basic materials. China's PPI was also a little "hot" and the bid in commodity stocks will remain strong.

Hurricanes devastated the southern states and Puerto Rico. Construction spending will jump and this will result in strong economic growth.

The budget resolution should get approved this week and this will provide a small spark. Politicians will shift the focus to tax cuts.

Swing traders should be long November and December calls. As I mentioned yesterday, if you are on the sidelines you should be aggressively scaling in right now. The last leg of this rally will unfold gradually, but an explosive day is likely in the next two weeks. That move could be the best one we see the remainder of the year. I will take profits on any 30+ plus point S&P move in a day.

Day trading has been extremely difficult given that intraday volatility is down 49% year to date. I have been making most of my money on swing trades. If the market retreats during the day I have been buying NASDAQ and S&P 500 futures. This tactic has worked well. If the market opens higher I spend the day reviewing earnings reports and looking for new stocks to swing trade.

I don't see any speed bumps ahead. Even though the market is overbought, it can stay that way for a very long period of time. Asset Managers who were waiting for a dip are getting anxious. They will start to aggressively bid for stocks because they don't want to miss a year-end rally.

Stay long!

.

.

Daily Bulletin Continues...