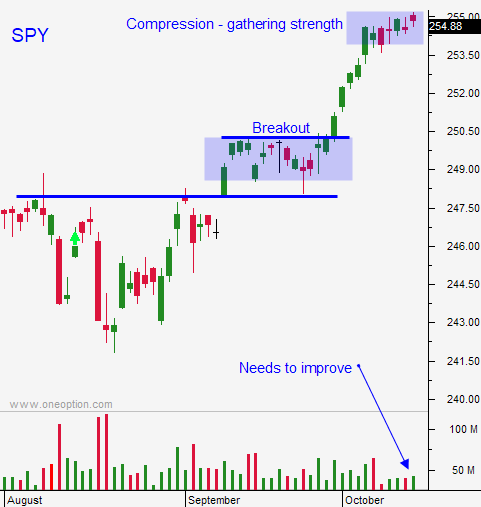

Buy Calls – Probability of A Market Breakout Is High This Week

Posted 9:15 AM ET - The market is trying to push higher but it lacks a catalyst. Earnings season will crank up this week and it will attract buyers. Q3 guidance was the strongest we've seen in five years.

Banks posted decent results last week, but good news was priced in and most financials retreated after the announcement. The first few days this week will be dominated by this sector and that could weigh slightly on the market. As the week unfolds we will hear from many other sectors.

Netflix will release earnings after the close today, but other mega cap tech stocks will not post until next week. FANGs have been leading the charge for most of the year and buyers will remain engaged through Apple's earnings on 10/26. Look for a strong market bid this week.

Trump is laser focused on tax cuts. Any progress on this front will attract buyers and this has the same effect as a protective put. Any dip will be brief and shallow. Analysts believe that the budget resolution will be passed by a narrow margin this week.

The probability of a "nasty" down day is diminishing. If we get through Wednesday bullish speculators will not get flushed out. Asset Managers who have been waiting for a dip will start aggressively buying.

Swing traders should be long November and December calls. If you are on the sidelines you should be scaling in the next few days. I am adding to my swing positions.

Day trading has been extremely difficult. Intraday ranges have been compressed by 49% year to date. Program trading is partly responsible. A lack of uncertainty has also contributed. The market has been in a steady grind higher and option implied volatilities are at historic lows. I'm not day trading much unless I get a down open.

Look for a steady grind higher this week on good earnings.

.

.

Daily Bulletin Continues...