Market At An Important Juncture – Watch For Tech Reaction Friday

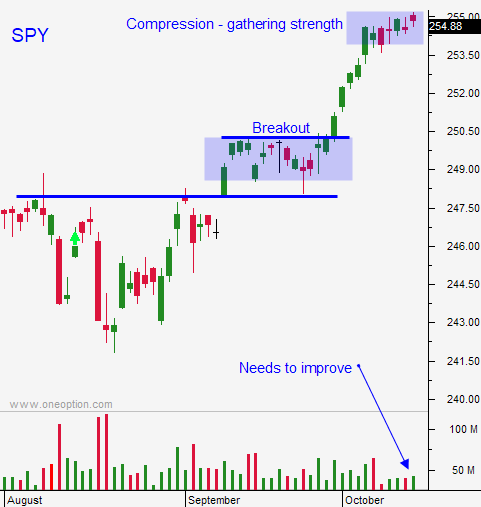

Posted 9:30 AM ET - Monday the market gapped to a new all-time high and it reversed forming a bearish engulfing pattern. If not for seasonal strength and earnings season, I would short the market. That pattern will take a few days to resolve and the market needs to stabilize this week. If it doesn't, it will roll over.

Mega cap tech stocks (FANGs) typically rally into earnings season. This pattern has been repeating for many quarters. Tech is weak and these stocks are not leading the charge. Amazon, Microsoft, Intel, Bidu and Google post after the close tomorrow. If the results are good this little speed bump will be resolved and the market will rally to a new all-time high. Some of the tech weakness is due to rotation into other sectors.

This is typically a very bullish time of year. Experience has taught me not to short from the middle of October through year-end. If the market struggles to tread water I will exit my longs and wait for support.

The macro backdrop is still very bullish. Any decline will be brief. There is a possibility that the tax cut is passed, economic conditions (domestic and international) are good, credit concerns are low and earnings have been excellent.

Swing traders should be long November and December calls. Use SPY $255 as a stop on a closing basis. I would avoid tech and I would focus on financials and industrials.

Day traders might have an opportunity today. The market will open lower and once support is established I will buy futures. I will also look to day trade stocks from the long side. Intraday volatility has dried up and I will only day trade down opens while this condition exists.

We could see a little weakness while the market digests earnings news. The announcements are very heavy the next week. The reaction to tech earnings Thursday night will be very important.

If we are stopped out of call positions (SPY closes below $255) we will lock in profits and wait for a better entry point. The market backdrop is still very bullish - do not short.

.

.

Daily Bulletin Continues...