Market Breakout – Now or Never – This Week Will Set the Year-End Tone

Posted 9:40 AM ET - If the market is going to breakout it needs to do so this week. The calendar is full and a catalyst needs to emerge. Strong earnings/guidance, a dovish FOMC statement or solid economic data could attract buyers. Once this window passes, the tone will be set for the rest of the year.

Earnings season will climax Wednesday and the results have been good so far. The strongest companies announce early in the cycle and optimism builds. Facebook will post after the close today and Apple will post after the close Wednesday. Mega cap tech reactions (Google, Amazon, Intel, and Microsoft) were good.

The FOMC will release its statement tomorrow. In September they projected four rate hikes in 2018 and that was greater than the three rate hikes analysts had projected. Inflation has been lower than expected and the Fed might use that to soften the rhetoric. Job growth slowed due to the hurricanes and they might want to gauge the rebound before they start pounding the table for more rate hikes.

ISM manufacturing and ISM services were strong last month. GDP came in at 3% and that is a strong number. China's official PMI came in a little light for October. We should see a strong rebound in job growth and analysts are expecting 285,000 new jobs in October. All told, the numbers should be market friendly this week.

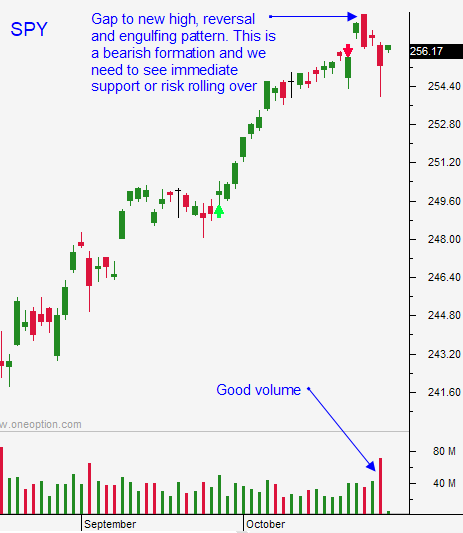

Swing traders should hold on to call positions. If we are going to breakout it will happen this week. If the market does not breakout we will flat line near the all-time high and Asset Managers will wait for a tax cut. All of the news will be priced in this week. The dips will be brief and shallow and the rallies will see some profit-taking. Stocks will trade in a narrow range the rest of the year if there is not a tax cut. Swing traders should use SPY $255 as a stop on a closing basis.

Day traders need to be cautious. I don't like trading higher opens. If we get a pullback I will wait for support and I will get long. If the market continues to grind higher I will ride my swing trades. The intraday volatility has decreased dramatically this year and I'm making most of my money on swing trades.

This is a critical week for the market. If we breakout we could see a nice grind higher for two more weeks. If the market can't get through the all-time high it will compress in a tight trading range while it waits for a tax cut.

Stay long and watch for breakout.

.

.

Daily Bulletin Continues...