Senate Will Try To Vote On Tax Cut Dec 1 – Bid Will Be Strong Until Then

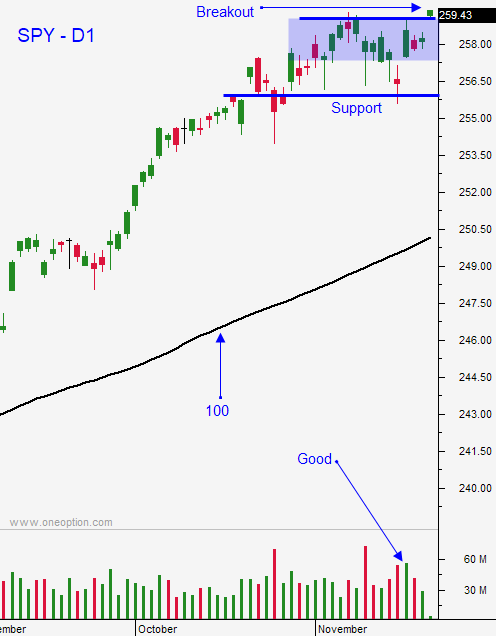

Posted 9:30 AM ET - Yesterday the market made a clean break to a new high. We are seeing follow-through this morning and the path of least resistance points higher. Trading volume will be very light.

Senate Republicans should be very motivated to get the tax deal done before the Alabama elections. If they lose a Senate seat tax cuts may not happen. I'm hearing rumors that the Senate will vote on December 1.

Yellen said that inflation is low and that is dovish. This will calm nerves ahead of the rate hike in December and the transition to Powell. The FOMC minutes will be released today and they should be market friendly.

For the time being missile tests in North Korea have subsided. Trump's tactic of putting pressure on them via China is working.

Earnings season has been excellent and economic growth is steady.

Swing traders should be long calls and you should have added yesterday when the SPY closed above $259. Use $256.50 as your stop on a closing basis.

I would not suggest trying to day trade today. The intraday range will be tight. If anything, trade from the long side and by a few futures contracts. Try to ride the momentum higher and keep a tight stop.

Black Friday and Cyber Monday are fairly meaningless. As I recall the gains/losses from Friday are reversed on Monday. I don't typically trade on Friday and I will be taking the day off. I will not be posting market comments.

Spend time with your family and don’t worry about the market. The downside is very contained and stocks are likely to float higher.

Happy Thanksgiving!

.

.

Daily Bulletin Continues...