Market Will Float Higher This Week – Senate Tax Cut Vote Friday

Posted 9:30 AM ET - Last week the market made a new all-time high. The news has generally been good over the weekend and we should see a grind higher this week. There will be many important events that will drive the action.

Online retail sales from Black Friday were up 18% from a year ago. Brick and mortar sales are not yet available, but analysts feel that they will tread water. Cyber Monday sales are expected to hit $6.6 billion (almost as good as the $7.9 billion from Black Friday).

There are a number of economic releases due out this week. GDP, the Beige Book, ISM manufacturing and official PMI's will be posted. In general these releases should be market friendly.

Powell will be sworn in as the new Fed Chairman tomorrow and Yellen will testify before Congress on Wednesday. A December rate hike is expected and the market is comfortable with it.

The biggest wildcard of the week is tax cuts. The House passed its bill and Congress is expected to vote on Friday (possibly Thursday). Rumor has it there are some changes and they are working to find middle ground. There is a sense of urgency. Republicans want to pass the bill before the Alabama elections because they might lose a seat. Furthermore, debt ceiling negotiations will come into play in the next two weeks and that will serve as a distraction. Congress is only in session for 12 days the rest of the year. If tax cuts are passed we will see a nice year-end rally.

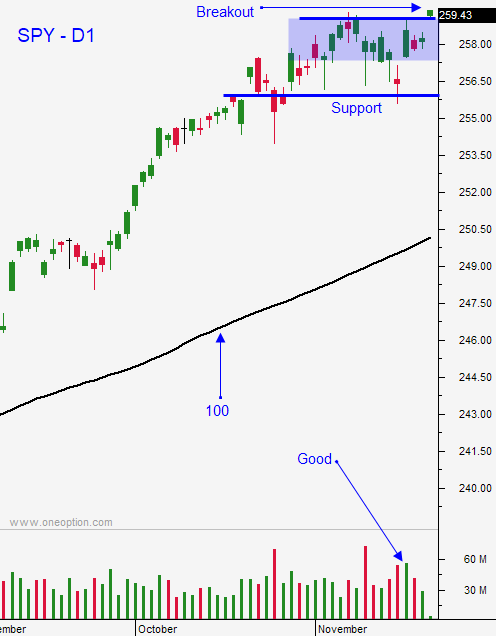

Swing traders should have a full call position. We purchased some calls early last week and we added to positions when the SPY closed above $259. Use SPY $256.50 as your stop on a closing basis. Once we get a little more breathing room we will raise our stop to $259 on a closing basis. I'm expecting a gradual grind higher this week. Even if tax cuts do not get passed by Friday, Republicans will scramble to get this done early next week.

Day traders should keep their powder dry. Intraday ranges are compressed. If the market dips I will buy on support. I will not chase stocks higher when the market gaps up overnight.

A solid week of news releases should keep traders engaged. The volume should be good and seasonal strength will float us higher.

.

.

Daily Bulletin Continues...