Market Wants A Tax Cut – Here Is How I Am Playing It

Posted 9:30 AM ET - The market is floating higher on year-end strength. Republican Senators are scrambling to pass a tax cut bill and they will vote Friday. This is all the market cares about.

Tonight the Senate budget committee will vote on the tax bill. There are 12 Republicans and 11 Democrats. If it is passed it will go to the floor. If not, there are still ways to get it to the floor.

The tax cut bill will keep buyers engaged. Passage would lead to a nice year-end rally. Even if it doesn't happen this week, it will happen. Republicans know there is too much at stake. They also know that the debt ceiling will be an issue in the next few weeks and they know that they could lose a Senate seat in Alabama.

All of the economic releases (GDP, Beige Book, ISM manufacturing and official PMI's) are insignificant relative to the tax bill.

The Fed will go through a transition when Powell takes over. Investors are comfortable with the change.

Japan said that they believe North Korea will resume missile testing soon. If true, I don't think this will spoil the rally.

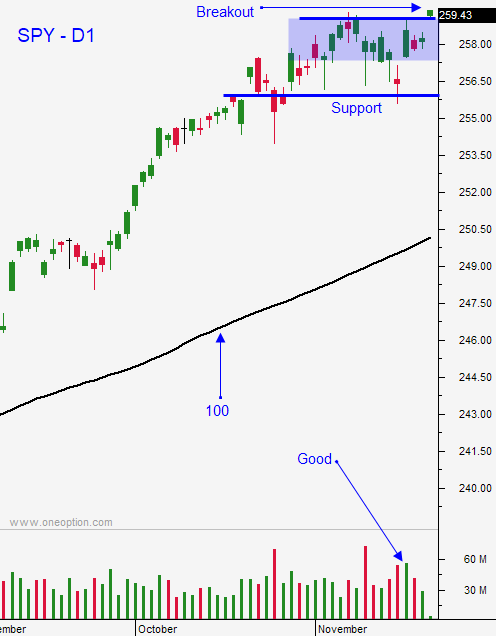

Swing traders should have a full call position. Use SPY $256.50 as your stop on a closing basis.

Day traders should keep activity to a minimum. Day trading ranges are extremely tight. If the market drops during the day you can wait for support and trade from the long side. Otherwise, stay sidelined.

I believe a tax bill will be passed and the market will rally. The debt ceiling will be a more difficult process and it could limit follow through after the initial move higher.

Look for quiet trading until the Senate vote.

.

.

Daily Bulletin Continues...