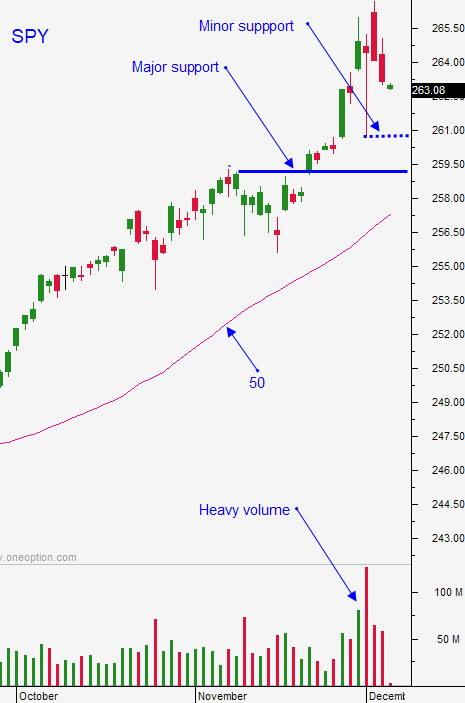

Big Drop In Tech Would Be Nice – Wait For This Pattern and Buy Calls

Posted 9:30 AM ET - As I mentioned in my comments yesterday the downside would be tested. Stocks looked good early and then started to slip mid-day. We are seeing follow-through selling this morning. A tax bill is priced in and we are a light round of profit-taking was expected. The SPY should find support at $260.

Tech stocks have been particularly weak and if the selling accelerates there will be an opportunity in this sector. I want to see an "air pocket" with a deep intraday low down to QQQ $149. If it immediately bounces I will buy mega cap tech stocks. Support is nearby at QQQ $147.40 (100-day MA) so there is a safety net.

Republicans are scrambling to get the tax bill approved by December 15th. They could lose a Senate seat in Alabama and the one vote margin of victory will be gone. Republicans also have to pass a continuing resolution before Friday to avoid a government shutdown.

Provided that all goes well for the GOP in the next week, they have to extend the debt ceiling in January. This will require 60 votes and Democrats will dig their heels in.

The Fed will hike interest rates a week from today. Yellen mentioned that four rate hikes are possible next year and that hawkish tone could be softened due to low inflation.

Earnings have been solid and they will dramatically improve in 2019 if corporate tax cuts are approved. This one-year delay could also pressure the market short term.

Economic growth has been excellent.

Swing traders should be sidelined. We took profits on our calls when the SPY closed below $265 on Monday. Now we need to wait for a capitulation low in tech stocks. That is our next opportunity.

Day traders can look for opportunities on the short side. Use the first hour low as your guide. A gradual drift lower will gain momentum. I don't expect to see any strength for another week.

I don't like to short the market or stocks into year-end so I will keep my trading to a minimum. I'm much more interested in catching the bounce that I am in shorting this little move lower. Get ready to buy this dip.

.

.

Daily Bulletin Continues...