Now You Have A Full Call Position – Get Ready For the Market Bounce

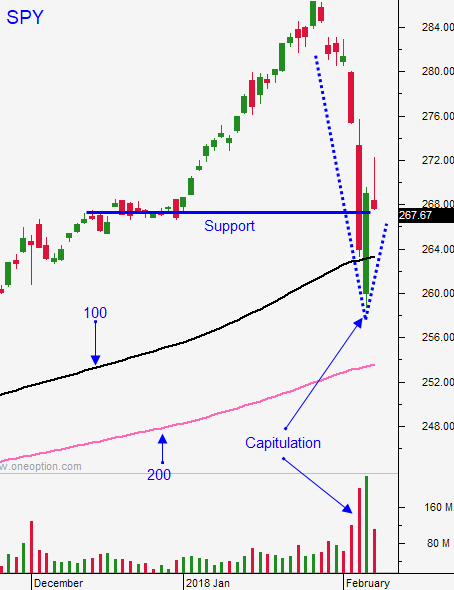

Posted 9:30 AM ET - The market is starting to find its footing. It tried to bounce yesterday and late day selling pushed it into negative territory. We can expect a few aftershocks, but a series of higher lows will attract buyers. Stay long.

Congress is going to extend the budget by two years and the debt ceiling by one year. It still has to be approved by the House and Paul Ryan has given his approval. The defense sequester will end and this will increase discretionary spending by $500 billion. The market had a negative reaction initially because this spending could stoke inflation. I see this as a huge positive for the market – no more deadlines and no more looking over our shoulders.

The Fed is expected to hike three times this year and officials have been calming the seas. They said that inflation has hit their 2% target, but that does not mean that aggressive tightening lies ahead. Domestic and international credit markets are extremely stable.

Earnings have been excellent and guidance is fantastic.

Economic data (ISM services, ISM manufacturing and ADP) has been strong. The Atlanta Federal Reserve is expecting Q1 GDP growth of 5.3%.

Interest rates have barely gotten off the deck. They are near historical lows and they have a long way to go before they impede economic growth. THIS IS THE SWEET SPOT OF AN ECONOMIC CYCLE.

Swing traders should have a full call position on. Expect a few dips in the next few days. Use the 100-day moving average on the SPY as your stop on a closing basis and get ready for a really nice run.

Day traders should look for opportunities to get long today. Let the market established a bid and buy stocks with relative strength.

We should see a nice rally in the next few weeks.

.

.

Daily Bulletin Continues...