2nd Mouse Gets the Cheese – Market Needs To Establish Support

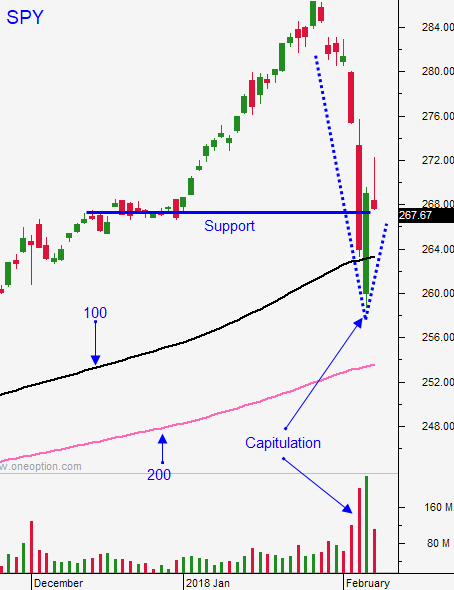

Posted 9:30 AM ET - The market is still probing for support. This bottoming process is going to take time and it will present an excellent buying opportunity. I was stopped out of my long position and I am waiting to reenter.

The macro backdrop is very bullish. Valuations are nowhere near "bubble" territory. The S&P 500 is trading at a forward P/E of 16.3 at current levels and it would be below 16 if we test the 200-day moving average. On a historical basis that is a little rich, but not extreme.

Earnings on the S&P 500 are expected to increase 17% this year. Bond yields have ticked higher, but they are still near historic lows. Interest rates will not impede economic growth which will exceed 5% in Q1. The Fed said that the inflation target of 2% has been met, but they don't intend to accelerate tightening. Given the recent market decline the new Fed Chairman (Powell) will have a dovish statement in March.

The budget was extended two years and the debt ceiling was extended one year. Some analysts are concerned that the $300 billion in additional discretionary spending over 2 years will be inflationary. According to the US Department of Commerce Q1 GDP will increase by $250 billion. Tax revenues as a percentage of GDP are about 20% and that means the government will collect an additional $50 billion this quarter due to economic growth. Economic growth increases tax revenues.

There is also a concern that higher interest rates will increase our interest expense. Considering $20 trillion in debt and a projected three quarters of a percent interest rate hike this year our interest expense will increase $150 billion. This is not chump change, but it is not disastrous either.

Credit concerns are very low on a global basis. Domestic write-downs from the financial crisis have been taken and lending practices remain tight.

Swing traders should buy the SPY at $253.56 (200-day MA). I am not going to buy the SPY if it gets above the 100-day MA today. We are likely to see choppy trading the next two weeks as support forms. In general, I do like the market and I see this as a buying opportunity. When the market finds support for a few days I will start selling out of the money bullish put spreads on stocks I like.

I bought the SPY earlier this week and I was stopped out when the it closed below the 100-day MA yesterday. I am still up nicely for the year.

Day traders need to use the first hour range as your guide. The market has been trending intraday once the momentum is established. If we are above the first hour high, focus on the long side. If we are below the first hour low, focus on the short side. Intraday volatility has been fantastic.

Look for a few more days of volatile trading and a possible test of the 200-day moving average. I am an aggressive buyer at that level.

.

.

Daily Bulletin Continues...