One Third of S&P 500 Will Post Earnings This Week

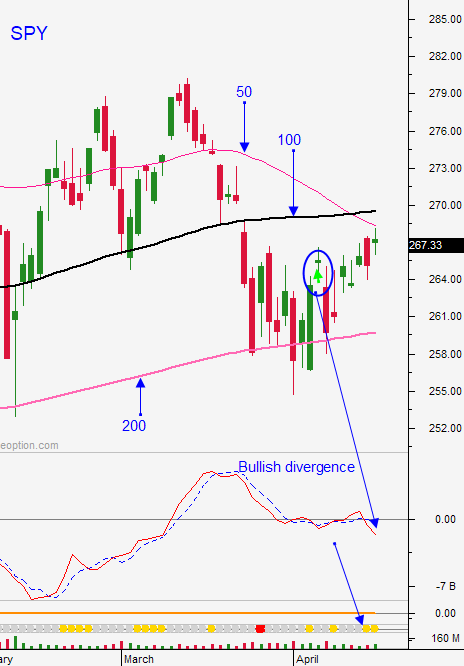

Posted 9:30 AM ET - Last week the S&P 500 briefly poked above the 100-day moving average. It was not able to hold that support level and now it represents resistance. Stocks dropped sharply on Friday on concerns that smart phone sales would be light. The NASDAQ 100 closed just above its 100-day moving average. This selling pressure is particularly bearish during the beginning of an earnings cycle.

Nothing calm nerves like profits. This week 180 S&P 500 companies will post results. Buyers are nervous and they are not scooping up stocks ahead of the announcements. Results will be excellent, but the expectations are high. The S&P 500 is trading at a current P/E of 25 and a forward P/E of 17. Valuations are at the high-end of the range and there is room for retracement.

10-Year US Treasury yields are testing the 3% level and that also has some investors nervous. This is a key support level for bonds and if it is breached the market will have another dark cloud to deal with. The FOMC meeting is a week from Wednesday and they plan to hike rates two more times this year.

The market has been reacting to political news. This front has settled down for the time being. North Korea will suspend nuclear missile tests and it wants to negotiate a deal. Trump does not trust them and he is taking a hard line with Kim Jon-un. The trade war mudslinging between the US and China has stopped. Successful airstrikes in Syria should keep the US out of the conflict. That was a dangerous mission and many things could've gone wrong. Investors were relieved by the outcome last week. The Russian collusion investigation will wind down with the help of Rudy Giuliani.

Economic data has been strong. This morning we learned that flash PMI's were better-than-expected. Strong growth and moderate inflation will help the market shoulder higher interest rates.

Swing traders need to be in cash. The S&P 500 never got above the 100-day moving average last Friday. We exited the XLF (scratch) and the XLE (nice gain) last week. The market could swing either way and we need to gauge the price action this week. I don't want to short the market during the peak of earnings season and I don't want to buy when the SPY is below the 100-day MA. Right now cash is king.

Day traders should favor the short side early today. Heavy selling on Friday will keep buyers at bay. They will not aggressively buy stocks below major support and sellers will test the bid early today. Use the 100-day MA for QQQ as your guide. If we are above it, favor the long side and if we are below it, favor the short side.

The next two weeks will set the tone for this summer.

.

.

Daily Bulletin Continues...