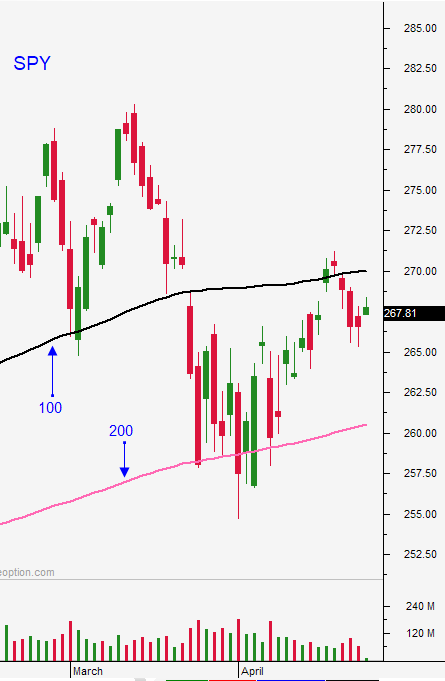

Market Has No FANGs – Earnings Have Not Sparked Buying – Red Flag

Posted 9:30 AM ET - Yesterday the NASDAQ 100 closed below major support. Mega cap tech stocks typically fuel the earnings rally and this catalyst is missing in action. Google posted decent results, but the stock is flat after the number. Earnings announcements will be heavy the rest of the week we will hear from one third of the S&P 500 companies.

Nothing calms nerves like profits. We should be seeing a nice grind higher, but the market has been soft. This is a warning sign. Good news is priced in and valuations are little stretched. Facebook will post solid numbers, but the privacy policy issues are a dark cloud. Apple could post mediocre numbers. Suppliers are reporting disappointing numbers. Google barely budged and FANGs are not going to lead the charge.

Earnings season is keeping the market afloat. As the quarter unwinds I believe the selling pressure will intensify.

Economic releases have been strong and flash PMI's were good yesterday.

Political news has not been much of a factor the last week, but that could change quickly. Yesterday Trump tweeted that a NAFTA agreement between the US and Mexico would hinge on border security. The market is fragile and any mention of trade restrictions prompts selling.

Interest rates are rising and US 10-year treasuries are on major support. The FOMC will meet a week from tomorrow and two more rate hikes are expected this year. If bonds break this key support level yields will start to climb.

Swing traders should be in cash. I don't want to short the market during the climax of earnings season. My sentiment is turning a little more bearish on a short-term basis. I plan to stay in cash for the next two weeks and I will be gauging the price action.

Day traders should use the first hour range as a guide. I believe the market will try to rally after a solid round of earnings announcements overnight. If the market is above the first hour high, favor the long side. If the market is below the first hour low, favor the downside. I will be looking for earnings plays and there is a very specific pattern that my Option Stalker system looks for. These real-time searches find fantastic day trading opportunities. I don't have a good feel for market direction and this is how I plan to make money the next few weeks.

The market should be in "go-go" mode during this phase of the earnings cycle. Instead, we have seen selling pressure and that is a red flag.

.

.

Daily Bulletin Continues...