Market Trying To Shoulder News – Any Surprise Favors the Downside

Posted 9:30 AM ET - I want to thank the brave men and women who have proudly served our country and who have protected freedom around the world. HAPPY MEMORIAL DAY!

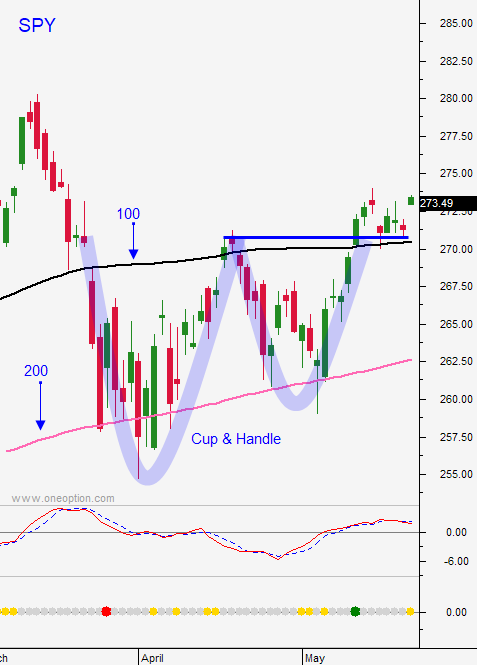

Yesterday we got a lightning strike from one of the dark clouds, but the market shouldered the news that Trump canceled the summit with North Korea. As I mentioned in my comments the trade deal with China hinges on denuclearization of the Korean Peninsula. I still believe that the market is walking a tightrope and many dark clouds are looming. We will maintain our short position and we will use SPY $274.30 as an intraday stop.

Trade wars are the biggest market threat and the European deadline is approaching. Steel and aluminum tariffs will go into effect on June 1 if a deal is not reached. NAFTA has been postponed until the Mexican elections on July 1. The US and China have temporarily called a truce while they work on the framework. I believe this joint statement was a nice way to spin the news. Both sides are still miles apart and Trump wants to see if China can keep North Korea at the table. Treasury Secretary Mnuchin said that steel and aluminum tariffs will remain and this was highly contested by China a month ago. China has made some minor concessions (autos and consumer goods) as a sign of good faith.

Our trading partners don't seem to be in a hurry to negotiate deals. They are happy with the status quo and they won't act unless they are forced to. Trump is impatient and he will demonstrate that he means business. He has been very consistent. When he says he is going to do something he follows through.

Economic conditions remain healthy, but flash PMI's in Europe and Japan were little light.

Corporate profits have been strong, but valuations are at the high end of the range.

The FOMC minutes were hawkish in my view. The Fed plans to accelerate tightening next year and officials want to normalize interest rates. The next Fed meeting is on June 13 and we can expect a quarter-point increase.

Trump is at war with the world and any surprise favors the downside.

Swing traders should be short SPY. Use an intraday stop of $274.30.

Day traders should use the first hour range as your guide. Support is at $270.65 and resistance is at $274. Trading volume will drop by mid-morning. Keep your size small and reduce your trade count. There are many dark clouds and traders are likely to reduce risk heading into a three-day weekend. .

.

Daily Bulletin Continues...