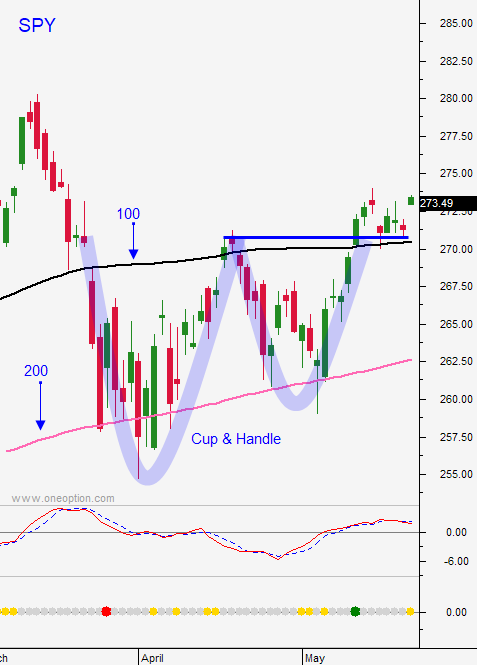

Our Puts Will Make Money Today – Look For Steady Selling Below SPY $270.70

Posted 9:30 AM ET - Last week I told you that any surprise favors the downside. Many dark clouds are looming and we had another lightning strike. Bond yields in Italy and Spain have spiked and credit risk is on the rise. The S&P 500 is trading below major support at the 100-day moving average before the open. We should see a heavy dose of selling today.

Credit risk is the one thing that can lead to sustained market declines. Yields have not reached critical levels, but PIIGS are once again on the radar. One of Europe's largest banks (Deutsche Bank) announced that it was laying off 25% of its workforce last week. When big banks struggle I pay attention.

Italy’s government has failed and it will hold elections (September) in hopes of establishing a ruling party. Spain is in a similar position. The commitment to staying in the EU is wavering.

US financial stocks did not rally when bank regulations (Frank/Dodd) were relaxed last week. This was a warning sign and now we know that credit risk is keeping buyers away.

The FOMC minutes were rather hawkish and the Fed will hike rates in two weeks. This will put upward pressure on global yields (bearish for emerging markets).

Trade wars are possible. Steel and aluminum tariffs will be imposed on Europe this week if a deal is not reached (June 1). Trade negotiations with China are tied to a successful summit with North Korea.

Swing traders are short the SPY from Wednesday's open ($271.17). We had to shoulder a small bounce, but we're in good shape this morning. Use SPY $274 as a stop on an intraday basis. If the market closes below $270.70 we will move our stop down to protect profits. I still consider this to be a low probability trading environment. If credit fears start to spread the selling pressure will build quickly.

Day traders should favor the short side. You can get fairly aggressive today as long as the SPY is below the 100-day moving average. We could see a nasty round of selling today.

.

.

Daily Bulletin Continues...