Market Caught In Political Crosswind – Sell Your Puts If This Happens Today

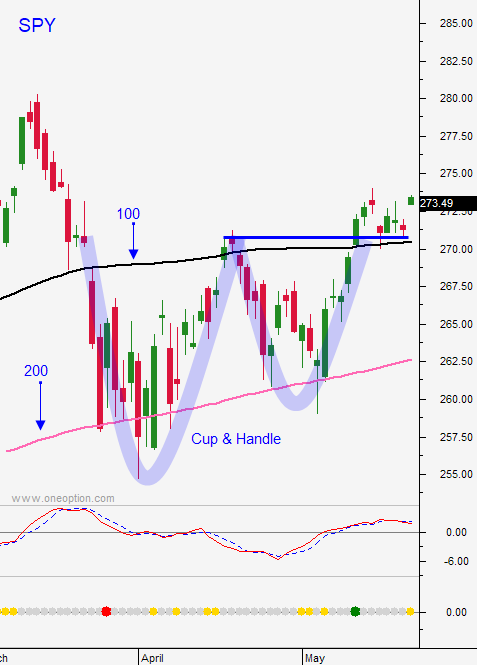

Posted 9:30 AM ET - Yesterday the market probed for support below the 100-day moving average. Buyers stepped in late in the day and losses were pared. An early rally this morning has the SPY back to the 100-day MA this morning. Dark clouds are looming and any surprise still favors the downside. This is a low probability trading environment.

Italy was the "crisis du jour" yesterday. Yields spiked and credit concerns are back on the radar. The selling abated overnight, but their government does not have a ruling coalition and elections are needed. Spain is in a similar situation.

Trump lifted sanctions against ZTE and that temporarily calmed trade negotiations with China. He later said that a $50 billion trade deficit reduction is needed to address intellectual property theft. China responded with harsh rhetoric. This battle will continue and the market will react to every comment.

Steel and aluminum tariffs will go into effect Friday if the EU does not negotiate an agreement. Trump seems steadfast in rebuilding the US steel industry. I have not read that progress is being made so this is a market threat. This would be the first step towards a trade war and it would demonstrate that Trump means business.

Mexico will hold elections July 1. The current president said that they will never pay for "the wall". This is in response to Trump's statement during a rally last night.

The FOMC will meet in two weeks. Analysts are expecting a rate hike. The market is more concerned with the accelerated tightening for 2019 that was referenced in the minutes last week.

The economic releases this week are heavy. ADP reported that 178,000 new jobs were created in the private sector during the month of May. The Beige Book will be released this afternoon and official PMI's will be posted tomorrow. ISM manufacturing and the jobs report will be released Friday. Economic growth should be steady and I'm not expecting any surprises.

Swing traders should lower their stop on the SPY to the 100-day MA on a closing basis ($270.70). If all of these dark clouds can't spark profit-taking today we will head to the sidelines. The market can chop around during the day, but we want to see a close below that resistance level.

Day traders should look for an opportunity to get short on the open today. Trade wars were the reason for the initial decline in February and the EU is on a deadline. This would be the first domino to fall. The European steel tariffs have been postponed once and a decision (one way or the other) will be known this week. After a heavy round of selling yesterday I believe the downside will be tested this morning. Use the 100-day moving average as your guide.

As I mentioned earlier, this is a low probability trading environment. Price movement is tied to political statements and the market is caught in the crosswind. Trim your size and your trade count. I like shorting the SPY and buying the QQQ when I see a move setting up.

I WILL NOT BE POSTING MARKET COMMENTS THURSDAY

.

.

.

.

.

.

.

.Daily Bulletin Continues...