Market Is Waiting For the Summit – This Is the Plan For Our QQQ Calls

Posted 9:30 AM ET - The market is broken through horizontal resistance and it is been able to hold the gains. Traders are giving politicians the benefit of the doubt while negotiations take place. These events will play out in the next week and we need to patiently wait for the outcome.

The North Korean summit will take place next week. I believe that Trump will keep the rhetoric friendly with China until then. He wants to get North Korea to the table so that he can gauge their commitment to denuclearization. If he senses that this is a farce he will intensify trade negotiations with China. If he feels that North Korea is willing to de-nuke he will be willing to make trade concessions with China. Kim Jong-Un is at the table because China has participated in economic sanctions. I believe this summit is critical to a trade deal with China. This is the first step in a long process.

Steel and aluminum tariffs will be imposed on the EU. They promised to retaliate and that news will weigh on the market.

A week from today the FOMC statement will be released and Powell will comment. A rate hike is expected and traders will watch for any signs of accelerated tightening in 2019. Global interest rates are poised to inch higher. The ECB is close to its inflation target and that could lead to hawkish comments next week. India just raised rates a quarter of a point and this is the first hike in five years.

Economic data points have been excellent. The jobless rate is at an 18-year low and ISM services was strong on Monday.

Corporate profits are increasing at a record pace and with each passing week valuations become more attractive (stocks are growing into elevated P/Es).

From a technical and fundamental standpoint the market looks attractive. Unfortunately, the price action has been driven by politics and those crosswinds are unpredictable.

Swing traders are long QQQ calls. Maintain your position and raise your stop to QQQ $174 on a closing basis. As the market moves higher we will raise our stop. Ideally, we will have a cushion heading into the news events next week. Then we can have an intraday stop at our entry price. That would give us a little buffer and allow us to participate in any rally without having much downside risk.

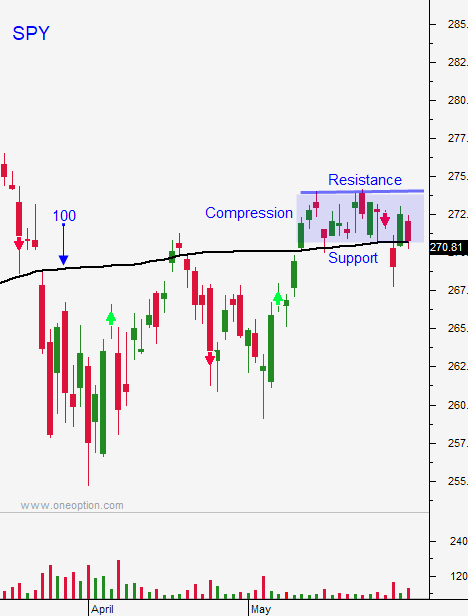

Day traders need to reduce trade counts and trade size. The market is waiting for major news events to unfold and we are in a holding pattern. Set passive targets. If the market breaks out of its first hour range, go with the flow. Support is at SPY $274.

Look for choppy trading with an upward bias. The political news should be fairly calm ahead of the summit next week.

.

.

Daily Bulletin Continues...