Q2 Earnings Will Trump Trade War Fears…… For Now

Posted 9:30 AM ET - Yesterday the NASDAQ 100 and the Russell 2000 tried to breakout to a new all-time high. Resistance held and overnight tariff news has sparked a round of profit-taking. Trade tensions are rising as the world's largest economies play "chicken". This threat has been looming, but investors have ignored it on the eve of earnings season.

Earnings season will start this week and analysts are expecting profits to rise 21% year-over-year. Guidance has been strong and there have not been many preannouncement warnings. At a forward P/E of 16 stocks are reasonably priced. The market will pay close attention to forward guidance and the potential impact of a global trade war. When companies start warming… investors will care. For now, new tariffs are merely a blind threat. It will take months for them to be instituted.

The countries with the largest trade surplus (China) have the most to lose and the Shanghai index is in bear market territory. It is down more than 25% from its high this year and it lost 2% overnight. I find it amusing that the US has been accused of bullying. China has been dictating foreign trade/investment policies, manipulating their currency and stealing intellectual property for decades. The greatest threat is that both sides escalate the trade war and that China's soft underbelly (shadow banking industry) is exposed.

China's shadow banking industry has $15 trillion in debt (almost the size of our entire national debt). Shadow banking yields have tripled from 5% to 15% in the last two years (a warning sign). Analysts estimate that 50 million homes are vacant and there is enough commercial office space to provide a 5' x 5' cubicle for every man woman and child in China. Corporate bond defaults are rising and halfway through the year they had reached three quarters of the record level posted in 2017. Trump knows real estate and having filed for bankruptcy, he knows the perils of over-leverage. Unfortunately, global credit markets are intertwined and what hurts China ultimately hurts the US.

Global credit is at unprecedented levels. This house of cards can last for many years as long as everyone "plays nice in the sandbox". You can argue who threw the first handful of sand, but in the end it won't matter. I am watching credit markets very closely.

To summarize, I am not worried about the potential impact tariffs might have on corporate profits or consumers. My greatest concern is credit.

The market is likely to discount the news. New tariffs won't go into effect for more than a month and there is time to negotiate. Corporations will not know which tariffs might be imposed so the warnings should be fairly light when they provide guidance. Generic statements are likely and that will not spook investors.

Swing traders should use IWM $167 as a stop on a closing basis. I believe the downside will be tested early and the market will bounce after an early low is established. To this point tariff wars have been discounted and there's no reason to believe that investors will start to worry about them on the eve of earnings season. Almost all of my trading these days has been intraday. The political crosswinds have made swing trading very difficult.

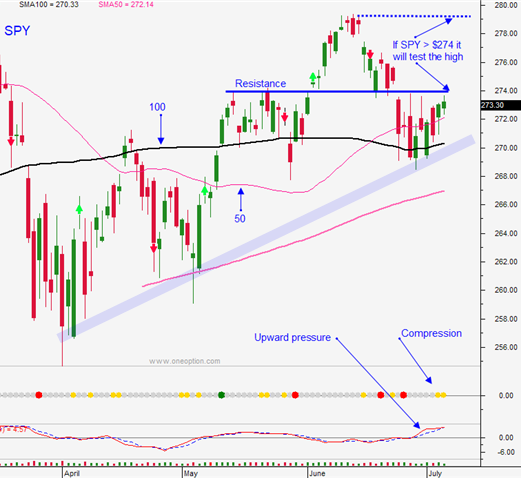

Day traders should evaluate the early action and they should use the first hour range as a guide. SPY $274 is support and $279 is resistance. I don't feel this scenario is likely, but if the SPY is down more than 30 points I will be looking for an intraday capitulation and an opportunity to trade from the long side late in the day.

Yesterday I told you this was a high probability trading environment, but I wrongfully assumed that the trade war tweets will subside for a few weeks since steel and aluminum tariffs had recently been imposed.

.

.

Daily Bulletin Continues...