Market Breakout – Let’s Take Profits Into Strength – Here Is Why

Posted 9:30 AM ET - Last week the S&P 500 made a new all-time high. The volume was decent ahead of a major holiday and Asset Managers don't want to miss a year-end rally. We are finally out of the summer doldrums and the economic calendar will be busy this week.

China's official PMI was slightly better-than-expected last Friday, but there are some warning signs. Production increased and so did inventories. That suggests that exports are not as robust as expected. Some analysts projected an inventory build and a small surge in demand ahead of tariffs. Trump might impose tariffs on $200 billion worth of Chinese goods by the end of the week. He will not be attending to trade conferences in Asia which would've provided an opportunity for him to meet with Xi. Trade negotiations have not progressed.

Trump's spent with Canada is escalating and he suggested that NAFTA might be dismantled. Both countries have until the end of the month to renew/reject/revise an agreement. The US needs to get six months notice before it can withdraw from the agreement.

ISM manufacturing will be released after the open this morning. ADP, ISM services and the Unemployment Report will be posted Thursday and Friday. I am expecting good numbers across the board.

The Fed will hike rates on September 26th. Traders will be watching if the word "accommodative" is changed to "neutral". That would be a sign that we are close to the end of this tightening cycle.

The continuing resolution needs to be approved by the end of the month. Trump wants a comprehensive immigration bill and he will use the budget as leverage. He has suggested that a government shutdown might be good. The market is discounting this threat. A market correction ahead of the November elections would not help the Republicans maintain control of the House and Senate.

This is a very tenuous rally in my opinion. The calendar is packed with potential speed bumps and we need to tread cautiously.

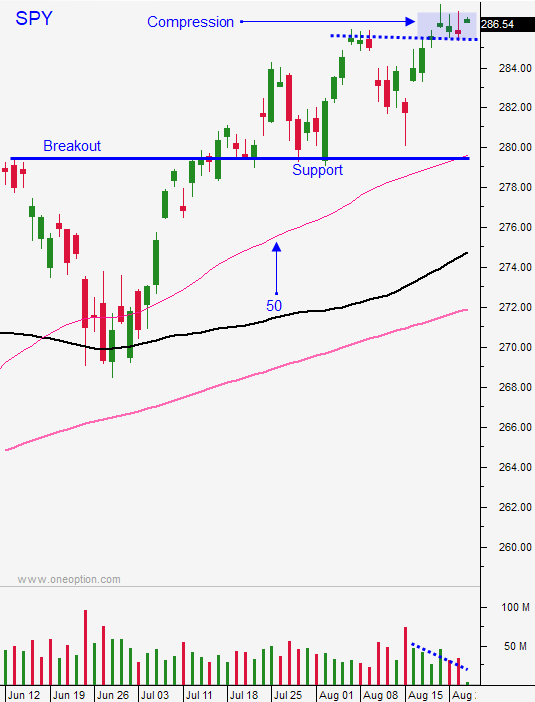

Swing traders bought SPY around the $283 level a few weeks ago and we added last week when the SPY traded above $287. Our average price is around $285 and we will use that as our stop on an intraday basis. Place an order to sell the SPY at $292. If we get a nice push higher we will take profits. I am not bearish, I just feel that we need to take profits into strength.

The breakout seems a bit vulnerable and I believe the events I've mentioned will spark some profit-taking. The SPY will test $287 and we need to see if buyers are still there. I would prefer to buy a retest and bounce off of that level. If $287 fails we could see a nasty little drop as bullish speculators get flushed out. Given the backdrop, I don't believe that the market will be off to the races without trade deals with our major partners (China, Europe and Canada).

Day traders should let the market come in today. Wait for support and look for stocks that have relative strength. Focus on the long side and use the first hour low as your guide. If the market falls below that level after two hours of trading we could see around of selling. The news over the weekend as a negative bias to it.

Tenuously stay long and use protective stops. If we get a nice rally we will take profits into strength.

.

.

Daily Bulletin Continues...