Swing Traders Need To Protect Profits – Day Traders Should Favor Short Side

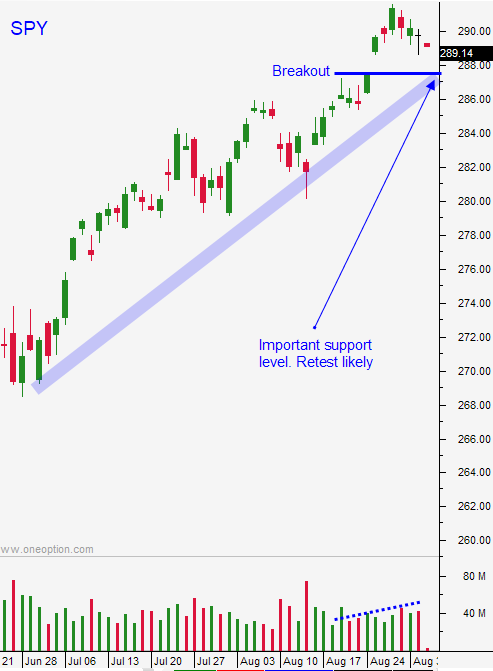

Posted 9:30 AM ET - Yesterday the market felt soft. Stocks probed for support and buyers were not anxious to chase this breakout. I suspect that support at SPY $287 will be challenged in the next two weeks and we need to evaluate the price action when that happens. We are going to take profits on our SPY position and there will place a stop and a target on the position.

The storm clouds are looming. Trade negotiations with China are dead in the water and Trump is not going to attend two Asian conferences that would've given him the opportunity to meet with Xi. Trump could impose a 25% tariff on $200 billion worth of goods this week.

Canada is in Washington today to try and patch up NAFTA. European trade negotiations are dragging along and there is no news on that front.

North Korea is continuing its nuclear development and Iran is threatening to shut down the Strait of Hormuz when sanctions are imposed.

Trump wants an immigration bill and he is threatening to veto the continuing resolution (government shutdown) if Congress does not make progress. The market is discounting this event because Trump needs to maintain his approval rating ahead of the November elections. If he re-Tweets this threat the market will pay attention.

The FOMC will hike rates on September 26th and analysts will be watching to see if the word "accommodative" is replaced with the word "neutral". This would signal that we are close to the end of the tightening cycle (dovish).

Credit markets have to be closely monitored at all times. This is the one thing that can lead to a prolonged market decline. Italy, Turkey, Argentina, Indonesia, Pakistan and a number of other sovereigns are showing signs of strain. This is my biggest concern. I also feel that the shadow banking industry in China ($17 trillion) could be in trouble if a trade war with the US unfolds.

Swing traders are long SPY at an average price of $285. We are going to stop the trade out on an intraday basis if the SPY is below $287. We will try to sell the SPY at $292 as well. We want to bracket this trade (stop and limit) to lock in profits. If the breakout at SPY $287 fails easily, I might consider shorting the market. We are not there yet so let's see how the rest of the week plays out.

Domestic economic releases (ADP, ISM manufacturing, ISM services and the Unemployment Report) will be good. Unfortunately, there are many headwinds that will overshadow these numbers.

Day traders should look for opportunities to short the market today. If we get a nice bounce early I will be looking for stocks with relative weakness. If the market is below the first hour low I will be more aggressive with my shorts and I will use that first hour low as my stop.

I feel that the market could be in trouble the next few weeks. Asset Managers see the storm clouds and they are not aggressively buying this breakout.

.

.

Daily Bulletin Continues...