Market Should Bounce This Week – We Bought the Dip – Use This Stop

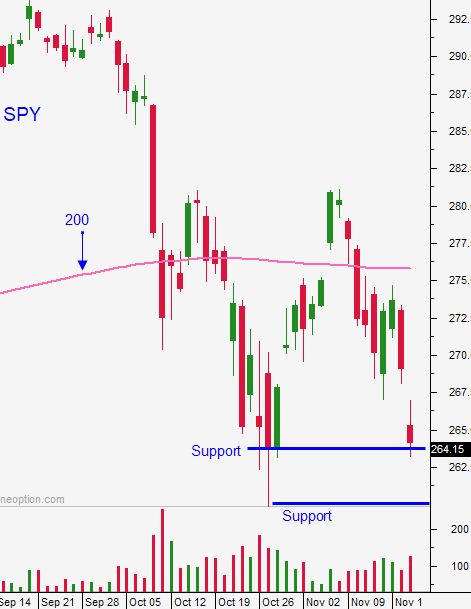

Posted 9:30 AM ET - The market has been very weak during a historically bullish time of the year. Trump and Xi will meet at the end of the week and I believe the rhetoric will be encouraging. Stocks are staging a relief rally this morning and we will see if the gains hold. Swing traders bought the SPY on Friday at $263.50 and we will place an intraday stop at $264. I don't want to lose money on this trade.

The FOMC minutes will be released Thursday. Traders will be looking for a softer tone from Fed officials.

Trump and Xi have nothing to gain from contentious comments after they meet. Both leaders need to calm investor nerves. I expect to hear that negotiations will continue and that Trump will temporarily postpone tariff increases during the process. This would rally stocks, but the bounce will be temporary.

There are rumors that Italy might consider some concessions to its 2.4% deficit spending. Leaders from 27 EU states formally backed Theresa May's Brexit withdrawal agreement. The issue is getting the agreement through stiff resistance in the UK Parliament. Both events are attracting buyers and stocks are up in Europe.

Trump is threatening to shut down the border with Mexico. He wants Mexico to control its side of the border. The wall is more important than ever and he may shut down the US government if he does not get funding for it. The budget has to be passed by December 8 (continuing resolution).

There are still plenty of landmines, but the market is oversold. We should get a nice little relief bounce off of the G20 meeting. Any hint that the Fed might be more dovish (Fed Minutes Thursday) will also help this week. I believe the market could rally to the 200-day MA. Swing traders bought the SPY when it traded below $263.50 Friday. Set a target of $275.80 and have your stop at $264 (intraday).

The continuing resolution (12/8) and the December FOMC (12/19) will keep a lid on the rally

Day traders should wait for the downside to be tested today. Overnight gaps higher have been faded and this one could reverse. Once support is established, favor the long side. Bearish sentiment is high and we could see a short squeeze this week. SPY $265 is the high from Friday and I would like to see that support level hold.

Look for a bullish week. Trade from the long side, use intraday stops and set passive targets. I want to see late day buying and follow through overnight. This bounce won't last more than a couple of weeks.

.

.

Daily Bulletin Continues...