Market Should Bounce As Shorts Get Squeezed – Use Intraday Stops

Posted 9:30 AM ET - The calendar is filled with major news events Wednesday through Friday. I'm expecting a small relief rally that lasts a week and then the selling should resume. Powell will speak on Wednesday and we need to hear dovish remarks. The FOMC minutes will be posted Thursday and they will reveal if some Fed officials are worried about a slowdown in global economic growth. On Friday China will post its PMI and Trump will meet with Xi at the G20 meeting. I'm expecting slightly dovish remarks from the Fed and market friendly comments from Trump after the meeting.

Yesterday Trump said that he plans to increase tariffs on the existing $250 billion of Chinese goods from 10% to 25%, but he won't expand tariffs on the remaining $260 billion worth of imports. Stocks are down on the news. The expectation was that no tariff increases would happen as long as trade negotiations are progressing. Both leaders realize that economic growth is fragile and that they both could benefit from conciliatory statements. This will spark a small relief rally. Bearish sentiment is high and we are due for a short squeeze.

Unfortunately, any bounce will be temporary. There are many dark clouds on the horizon.

The Fed has been steadfast in tightening. Even during the 10% market correction they did not flinch. Global economic growth is sluggish and they have not mentioned it in their statement. A sliver of dovishness would go a long way into year-end.

Italy is still resisting budget changes. Some analysts believe that they will decrease their deficit from 2.4% to 2.2%. The EU is likely to impose stiff fines.

Brexit negotiations are progressing with regards to the EU. Theresa May has to get the deal through Parliament and that could be very difficult since her party is a minority.

Trump might shut down the border with Mexico to keep the caravan out. This would impact trade. The wall is a priority and Trump could shut down the government (12/8) if he does not get an additional $5 billion to build it.

Russia has captured three Ukrainian naval ships and imprisoned the crew. Tensions are escalating and the Ukraine fears a Russian invasion. The Ukraine has imposed martial law.

GM is closing five factories and it will lay off 15,000 workers. This could be a warning sign for domestic economic growth.

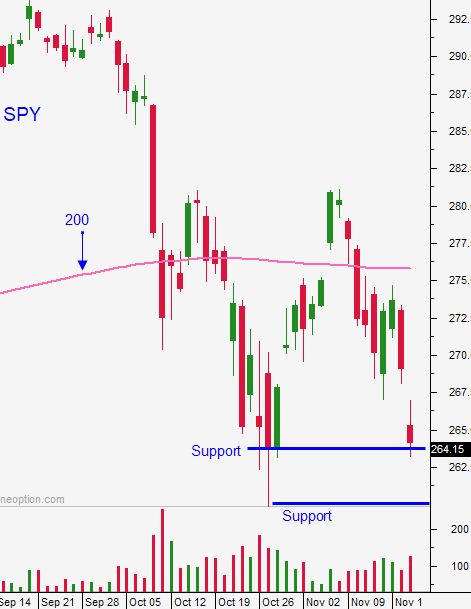

A hint of dovishness from the Fed and good optics from the G20 meeting should spark a small rally to the 200-day MA. Swing traders are long the SPY at $263.50 and we will use an intraday stop of $264. Our target is $276. Unfortunately, there will not be a trade agreement anytime soon and the Fed will still hike rates in December. We don't want to overstate our welcome on the long side and it is critical that we maintain intraday stops and raise them as the market moves higher. Bearish speculators will be flushed out and once the bounce stalls a good shorting opportunity will present itself.

A possible government shutdown and a rate hike on 12/19 will spook buyers. Negative developments in the Ukraine and discourse in Europe (Brexit and Italy) could weigh on the market. In a matter of weeks the G20 honeymoon will be over and Trump will start throwing punches at China again.

Day traders should patiently wait for buying opportunity today. Support is at SPY $263 and resistance is at $268.50. Use the first hour range as your guide.

I am looking for a relief bounce this week fueled by short covering. The comments from the Fed and the G20 meeting will be better than feared (but not great).

.

.

Daily Bulletin Continues...